TFO Wealth Partners Named to Financial Planning’s 2025 RIA Leaders List Top 150 Fee-Only RIAs

TFO Wealth Partners has been named to Financial Planning’s 2025 RIA Leaders list of the top 150 fee-only advisory firms across the country.

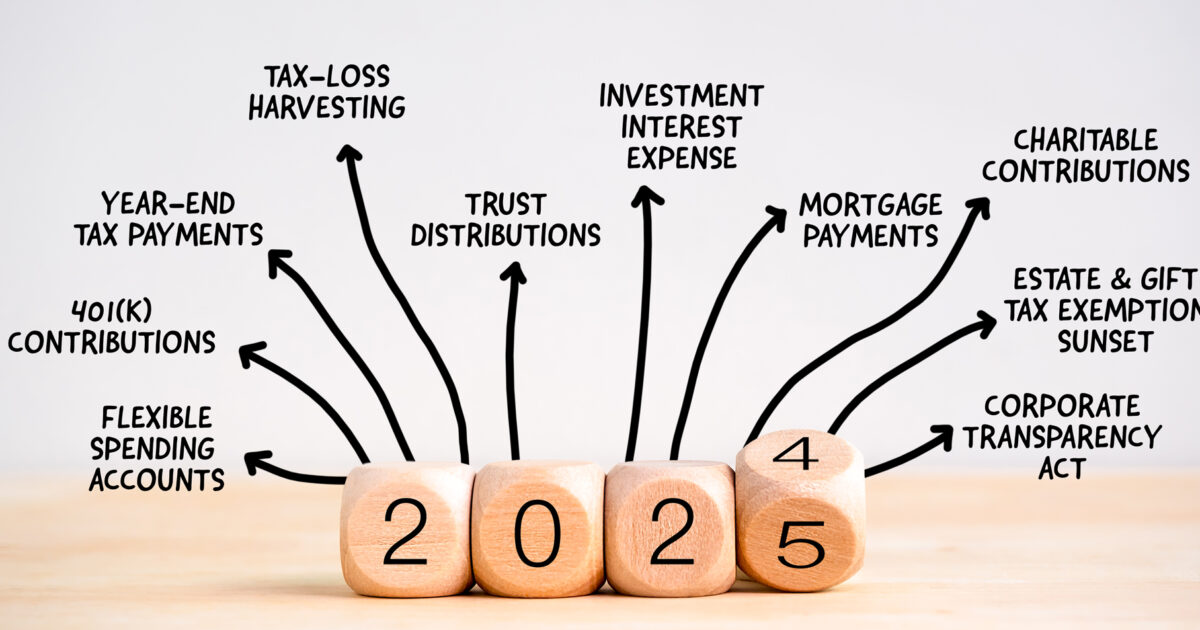

2025 Year-End Planning: Control The Things You Can

As we head for the year’s home stretch, there is a host of planning items you should consider as well as some general information you should be aware of for the coming year. Read our year-end planning considerations checklist.

The Seven Disciplines of Families Who Pass on More Than Money with David York

You’ll hear why the best wealth transfer plans start with values, not spreadsheets, and how tools like COREnology are helping families measure culture, not just cash flow.

Leadership Lessons That Last: Building Trust, Values, and Legacy

General Frost’s insights are a must-hear for anyone seeking to lead with clarity, strengthen family legacy, or create a culture of trust in business and at home.

Introducing ‘Numbers and Narratives’: A New Quarterly Look Past Market Headlines with Matt Sheridan

We’re excited to introduce Numbers and Narratives — A Quarterly Look Past Market Headlines from TFO Wealth Partners. Each quarter, our Chief Investment Officer Matt Sheridan shares simple visuals, key takeaways, and a brief video to help you stay informed on the markets and economy — without all the noise.

TFO Wealth Partners Once Again Named One of America’s Top RIA Firms by Forbes/Shook

TFO Wealth Partners is thrilled to having been named once again as one of America’s Top RIA Firms by Forbes/Shook for 2025. We congratulate our team who help make these accolades possible and to all of the others firms named to this year’s list.

A Quick Perspective on the Government Shutdown

As of early Wednesday, government funding has lapsed after lawmakers and the White House failed to reach a spending deal. This has triggered a shutdown that will pause certain federal services and likely furlough a large number of federal employees.

Who’s Your Trustee? Why It Matters More Than You Think

In this episode, Donald shares how trustees juggle administrative, investment, and distribution duties and why “not knowing what you don’t know” can be a costly mistake.

Why Great Families Are Built, Not Born: Lessons from Bruce Feiler

In this episode, Feiler shares how a single family meeting transformed his household—and later, his three-generation family business. The power of structure, the stories that strengthen resilience, and the role of rituals over rules.

Why 90% of Wealth Disappears, and the Question That Changes Everything

In this episode, we explore why 90% of families lose their wealth within three generations—and what the 10% do differently. From legacy letters to banana peels to reflections on time, we see how families can pass down meaning, not just money.

Why Wealth Without Purpose Falls Short: Lessons from the Families Who Live It

Money without meaning leads to a disconnect, and too often, that’s the story of high-net-worth families. In the first episode of The Wealth and Purpose Podcast, Brady Fineske, CFP®, opens up about what truly drives his mission: helping families bridge the gap between financial success and emotional fulfillment.

Introducing The Wealth and Purpose Podcast: Now Streaming

We’re proud to officially announce the launch of our podcast, hosted by TFO President Brady Fineske. This show was created for families and business owners who want to make the most of what they’ve built—not just financially, but personally and generationally.

Balancing Family Preferences and Needs When Securing a Second Home

A second home is more than an investment—it’s a place to create memories and build a legacy. Thoughtful planning can help balance family preferences, align with your values, and ensure it becomes a source of joy for generations.

TFO Wealth Partners Named to FA Magazine’s List of America’s Top RIAs for 8th Consecutive Year

We’re honored to share that TFO Wealth Partners has been named to Financial Advisor Magazine’s 2025 RIA Survey & Rankings list! This recognition reflects our unwavering commitment to helping families thrive by connecting their wealth and purpose. Thank you to our clients and team for being part of this journey.

Should You Treat Your Kids Equally In Your Will? Finding the Right Balance Between Equal and Fair

Should you treat your children equally in your will? It’s one of the toughest—and most personal—questions families face during estate planning. Equal may seem fair, but sometimes fairness requires a deeper look at each child’s unique circumstances. In our latest article, we explore the emotional and practical considerations behind this important decision.

The One Big Beautiful Bill Act (OBBBA): What Families and Business Owners Need to Know

The One Big Beautiful Bill Act (OBBBA) is reshaping the financial landscape for families and business owners alike. See our summary and key planning takeaways.

Don’t Let the Noise Distract You: Four Charts That Matter with Matthew Sheridan

Worried about the markets? You’re not alone. In this informative video, TFO Wealth Partners Chief Investment Officer, Matthew Sheridan, shares 4 charts that every long-term investor should see.

Brady Fineske Recognized Among Top Advisors in the Country by AdvisorHub

We’re pleased to share that Brady Fineske, President of TFO Wealth Partners, has been named to AdvisorHub’s 2025 “1,000 Advisors to Watch” list, ranking #8 in the RIA category.

Balancing Retirement and Caregiving: How to Budget for Both

Retirement is a time to enjoy the fruits of your labor—but what happens when you also need to care for aging parents? Navigating both can be challenging, but with the right financial strategies and emotional support, it’s possible to balance both your retirement goals and caregiving responsibilities.

The Ultimate Downsizing Checklist: Simplifying Your Next Chapter

Check out our latest article that offers a step-by-step checklist to help you simplify the process—from defining your goals to finding the perfect new space. Get expert tips and guidance to make your transition smoother.

TFO Wealth Partners Has Been Named an RIA Team of the Year

We are proud to announce that TFO Wealth Partners has been named an RIA Team of the Year (10 or more Advisors) category for the 2025 InvestmentNews Awards.

Building Wealthy Habits: Six Books for Guiding Your Kids to Financial Freedom

Check out our latest article “Building Wealthy Habits: Six Books for Guiding Your Kids to Financial Freedom” that highlights six impactful books that can help parents guide their children toward financial independence.

TFO Family Wealth Strategist Named to Forbes 2025 Best-in-State Wealth Advisors List

TFO Wealth Partners is thrilled to one of its Family Wealth Strategists named to Forbes Best-in-State Wealth Advisors list for 2025. While we cannot name the specific advisor to make the list, we believe this recognition reinforces our commitment to helping our clients connect their wealth and purpose. These individual recognitions aren’t possible without the hard work and diligence of our team.

Chris Winters Named to PLANADVISER’s 2025 Top Retirement Plan Advisers List

We are proud to announce that Chris Winters, TFO Wealth Partners' Director of Retirement Plan Services, has been recognized as one of PLANADVISER’s 2025 Top Retirement Plan Advisers.

Perspective on the Headlines: Staying the Course

Markets are moving - and so are the headlines. But volatility isn’t new. This chart shows how often the S&P 500 has experienced corrections since 1950. Market pullbacks are normal, and they’ve always been part of the journey to long-term growth. Discomfort and uncertainty are the price of admission - and why staying the course matters.

Nine Technology Trends for Enhanced Travel Experiences

Check out our latest article “Nine Technology Trends for Enhanced Travel Experiences” to maximize fun and efficiency on your next trip.

Brady Fineske Recognized as a Barron’s Top 1,200 Financial Advisor

We’re proud to share that Brady Fineske, TFO Wealth Partners President and Lead Strategist, has once again been named to Barron’s Top 1,200 Financial Advisors list for 2025! This is the third consecutive year of Brady being recognized on this list. We believe this is a reflection of his dedication to helping families thrive by connecting their wealth and purpose.

Update on Beneficial Ownership Reporting – New Deadline Announced

We’ve been keeping you informed about the evolving requirements surrounding the Corporate Transparency Act (CTA), and we wanted to provide the latest update. On February 17, a federal district court judge in Texas lifted that suspension, officially reinstating the reporting requirement.

Brady Joins the Managing Your Practice Podcast

TFO Wealth Partners President Brady Fineske visited with Dimensional Fund Advisor’s Catherine Williams on the “Managing Your Practice” Podcast. Brady offered his insight and experience for the advisor community on the important connection between health and wealth and touched on a few of the TFO tools we’ve built to ‘be more’ and make meaningful impact for our client families.

Evaluating the Readiness of Family Members To Join or Take Over the Family Business

Evaluating the readiness of your children or family members to join or take over the business is one of the most important decisions you’ll make. This article explores how to assess their passion, skills, leadership potential, and alignment with your family values to ensure a smooth and successful transition.

Location, Location, Location: Choosing the Right Area For Your Second Home

For many high-net-worth families, purchasing a second home is more than a real estate transaction—it’s an investment in lifestyle, legacy, and long-term value. Here's what you need to consider when choosing the perfect area for your second home.

Simplify Your 2025 Tax Planning: Download Our New Tax Reference Guide

Our 2025 Tax Reference Guide is now available. This resource is being provided to allow you quick access to tax-related data points that may impact you over the 2025 tax year.

Welcoming a Son- or Daughter-in-Law Into the Family Wealth Conversation

Bringing a son- or daughter-in-law into your family's financial discussions is a big step. How do you share your family’s values, decide what information to disclose, and set clear roles in the conversation? Thoughtful planning is key to building trust and preserving your legacy.

2024 Year-End Planning: Control The Things You Can

As we head for the year’s home stretch, there is a host of planning items you should consider as well as some general information you should be aware of for the coming year. Read our year-end planning considerations checklist.

2024 Young Professionals Award by the Family Wealth Alliance

We are thrilled to announce that Bruce Cartwright, TFO Wealth Partners Family Wealth Strategist, has been honored with the Young Professionals Award 2024 by the Family Wealth Alliance. Congratulations, Bruce, and well deserved!

Markets and Elections Part 6: Recap and Conclusions

As we said in the beginning, a picture is worth a thousand words, and when it comes to the impact of Presidential elections on markets and your portfolio (or lack thereof) below is a quick infographic we've created to recap our series along with a final conclusion.

Markets and Elections Part 5: Markets Have Rewarded Long-Term Investors Regardless of Which Party Controls Congress

In the last part of our series, we displayed how markets have risen regardless of who is President. The same is true over time regardless of which party controls congress.

TFO Wealth Partners Named Once Again to Forbes’ America’s Top RIA Firms List for 2024

TFO Wealth Partners is thrilled to have once again be named as one of the top RIA firms in the country by Forbes/Shook for 2024. It is always an honor to be recognized for the work we do towards our mission of helping families thrive by connecting their wealth and purpose. Congratulations to our team and all the other firms recognized on this list!

Markets and Elections Part 4: Markets Have Rewarded Long-Term Investors Regardless of Who Is President

Markets and Elections Part 4 - It’s common for investors to seek a link between presidential election outcomes and stock market performance. However, nearly a century of data shows that stocks have generally risen regardless of who is President.

InvestmentNews Feature Highlights What Makes TFO Wealth Partners Different

Recently, TFO Wealth Partners' Brady Fineske sat down with InvestmentNews to discuss our firm's mission of helping families connect wealth and purpose and a core value of our of 'being more' for our clients. Brady expanded on our holistic approach to touching all parts of our client's financial life, the proprietary solutions we've built to help them live the life they want, and our people and culture that help drive all that we do.

Markets and Elections Part 3: Annualized Returns During U.S. Presidential Terms

Markets and Elections Part 3 - You may still be interested in how the market has performed over Presidential terms. As you can see, on average, the market has experienced healthy growth over presidential terms, regardless of what party holds office.

Important Update: Corporate Transparency Act (CTA)

If you have an LLC, LP, corporation, or other legal entity for business or personal purposes, please read this update as it relates to the Corporate Transparency Act (CTA).

Facts and Fantasies About a Fed Rate Cut

At its September 17-18 meeting, the Federal Reserve (“the Fed”) is expected to cut the federal funds rate. We will discuss the elements of your financial world that you should expect to change if the Fed cuts rates, and others where a Fed rate cut will likely be less impactful.

Markets and Elections Part 2: Market Returns During and After U.S. Presidential Election Years

Markets and Elections Part 2 - Wondering how markets have reacted during an election year and/or the year subsequent to a Presidential election? Wonder no more.

Markets and Elections: Three Key Takeaways

The anticipation building up to Presidential elections often brings with it questions about how financial markets will respond. To help answer these questions (and maybe a few concerns), we will be posting a 6-part series. Here are three takeaways from this series.

Four Summer Activities That Could Affect Your Tax Returns Next Year

Summer is a time for relaxation, adventure, and making memories. While it's a season to enjoy, it's also a great opportunity to stay mindful of activities that could impact your tax returns. Here are four summertime activities that can have tax implications and tips on how to navigate them for a smoother filing season next year.

Sensitive Information Stolen in National Public Data, UnitedHealth Group Breaches: What You Need to Know

National Public Data Breach Affects Nearly Three Billion People. Whenever personal information is exposed in a data breach, it’s highly recommended that you take immediate action to protect yourself from harm.

The Importance of College Students Establishing a Budget for the Coming School Year

Helping the college student(s) in your family establish a thoughtful budget for the school year can help set the foundation for a lifetime of good financial habits. Here are six ways establishing a budget for the college year can help set up your family members for future success.

Normal Turbulence in the Stock Market

No one likes uncertainty, particularly as it relates to money and investments, but it’s important to remember that declines like this are totally normal experiences and happen often.

TFO Wealth Partners Named to FA Magazine’s List of America’s Top RIAs for 7th Consecutive Year

TFO Wealth Partners has once again been named as one of America’s top Registered Investment Advisory Firms by Financial Advisor Magazine in their 2024 RIA Survey and Rankings List. This is the seventh consecutive year our firm has been named to this list, which we believe is a direct result of the hard work of our dedicated team in helping families thrive by connecting their wealth and purpose.

Brady Fineske Recognized as an Advisor on the 200 RIAs to Watch by AdvisorHub

AdvisorHub has recognized TFO Wealth Partners and Brady Fineske as one of the advisors on the 200 RIAs to Watch list. Brady, who helps lead our firm’s mission of helping families thrive by connecting their wealth and purpose, was ranked #9 advisor on the list of 200 RIAs to Watch.

Making Sense of the $5.54 Billion Visa and Mastercard Landmark Settlement for Business Owners

Visa and Mastercard have recently agreed to a $5.54 billion settlement with merchants regarding excessive credit card interchange fees, commonly known as "swipe fees."

RIA Channel’s Top 50 Wealth Managers By Growth In Assets

TFO Wealth Partners named one of the Top 50 Wealth Managers in the U.S. by growth in assets by RIA Channel – we are thrilled with this most recent recognition, further evidence we are fulfilling our mission of helping our client families thrive by connecting their wealth and purpose.

Barron’s Top 1,200 Financial Advisors List

Brady Fineske, TFO Wealth Partners President and Family Wealth Strategist, has once again been named to Barron’s 2024 America’s Top 1,200 Financial Advisors list. Congratulations Brady on this recent honor.

The Next BlackBerry?

Some investors might suggest the success of the ‘Magnificent 7’ stocks stems from an environment favoring a “winner takes all” approach where a handful of companies achieve significant market share, ultimately suppressing competition. But reaching the top of one’s respective industry, and staying on top, are two very different things.

A Few Thoughts on Spending Money

As your family adviser, we spend much of our time discussing how to invest your money. However just as, or maybe even more important, is helping you determine how you ultimately want to use your wealth to achieve life fulfillment.

Our 2024 Tax Reference Sheet Is Now Available

Our 2024 Tax Reference Sheet is now available. This resource is being provided to allow you quick access to tax-related data points that may impact you over the 2024 tax year.

History in November

The holiday season is officially upon us, and with it comes our annual opportunity to gather family and friends and share joy with those we love. It also provides a great opportunity to share stories of the past year and look back at some memorable snapshots and historic moments of the past twelve months. In the financial markets, the month of November was analogous to one of those memorable candid snapshots.

Congratulations to Our Newest Partner – Jesse MacDonald

TFO Wealth Partners is thrilled to announce Jesse MacDonald has been named our newest partner. Jesse joined our firm in 2009 and has touched many facets of our family of companies, leading our marketing efforts and developing new products and solutions for our client families. His hard work and commitment are what we look for in a TFO colleague. Please join us in congratulating Jesse as our newest partner.

2023 Year-End Planning: Control The Things You Can

As we head for the year’s home stretch, there is a host of planning items you should consider as well as some general information you should be aware of for the coming year.

FA Magazine’s RIA Survey and Rankings 2023 List

We are proud to once again have been named to FA Magazine’s Financial Advisor Magazine’s RIA Survey and Rankings List for 2023.

Potential Benefits of Lifetime Gifts

Many estate plans include a program of making lifetime gifts which has the potential to offer important rewards and benefits. Here are some of these benefits you may want to consider.

Setting a Price for Buying or Selling a Business

In the overall U.S. business landscape, mergers, takeovers, and buyouts are occurring at a steady rate. If you were to place your business on the market would you know what it is worth? Setting the price is often the most important aspect of the transaction. In this article we tackle valuation methods, the important role of taxes, and the differences and considerations of a taxable and a nontaxable transaction.

A Helpful Overview Of All Your Digital Property and Digital Assets

Digital property (or digital assets) can be understood as any information about you or created by you that exists in digital form, either online or on an electronic storage device, including the information necessary to access the digital asset. All of your digital property comprises what is known as your digital estate.

Congratulations to Our Newest Partner – Adele Sobieszczanski

TFO Wealth Partners is thrilled to announce Adele Sobieszczanski, TFO Wealth Partners Executive Vice President and Family Wealth Strategist, has been named our newest partner. Through the years, Adele has been instrumental in every facet of our business, ultimately helping lead the creation of our registered investment advisory firm and helping grow it into what it is today. If you know Adele, you know her hard work, commitment to her team, and her never-ending focus on her clients are what we look for in a TFO Wealth Partners colleague. We thank you Adele for all you continue to do for us and congratulate you on this much deserved honor.

Family Business—Laying the Groundwork for Success

For business owners considering expanding their team and allowing family members to enter the business there are some questions you may want to ask yourself before jumping in, and succession plan considerations you won’t want to miss.

Barron’s Top 1,200 Advisors Rankings by State List

We are thrilled to announce that Brady Fineske was recently ranked #12 in Ohio on Barron’s 2023 Top 1,200 Advisors, evaluated as of September 30th, 2022. We want to congratulate Brady and recognize our team of colleagues who help make this possible.

Retiring Business Owners – Plan for Succession

If you’re a small business owner, you’ve invested a great deal of time and effort into building your company. With day-to-day demands, it may be difficult to imagine your eventual transition into retirement. Yet, if you want to build personal financial security and ensure business continuation, it is important to plan ahead. Business succession planning can help create retirement income for a retiring business owner and facilitate the transfer of operations and/or ownership to family or another entity. A succession plan can also provide a strategy to handle unforeseen events, such as death or disability.

A Look at Guardianship and Older Adults

Suppose an elderly family member becomes incapacitated and has made no arrangements for such a situation. Advance directives are legal instructions that express a person’s wishes regarding financial and health care decisions in the event that he or she becomes unable to make them. If incapacity occurs and there are no advance directives, is guardianship a viable option?

Involving the Family Can Be Good Business

If you’re fortunate enough to own a small business, has your enterprise flourished into something a bit more complex than you ever would have expected? If this sounds familiar, you probably also have experienced a gradual shift in your responsibilities—from being a person in complete control to a manager attempting to oversee many facets of the business.

Retirement Contribution Limits for 2023

The IRS just announced the 2023 contribution limits for qualified retirement plans which include significant increases. Notably, the employee contribution limit is rising almost 10% to $22,500. The catch-up contribution for individuals 50 or older is increasing by $1,000 to $7,500.

TFO Wealth Partners Named to Financial Planning’s 2025 RIA Leaders List Top 150 Fee-Only RIAs

TFO Wealth Partners has been named to Financial Planning’s 2025 RIA Leaders list of the top 150 fee-only advisory firms across the country.

2025 Year-End Planning: Control The Things You Can

As we head for the year’s home stretch, there is a host of planning items you should consider as well as some general information you should be aware of for the coming year. Read our year-end planning considerations checklist.

The Seven Disciplines of Families Who Pass on More Than Money with David York

You’ll hear why the best wealth transfer plans start with values, not spreadsheets, and how tools like COREnology are helping families measure culture, not just cash flow.

Leadership Lessons That Last: Building Trust, Values, and Legacy

General Frost’s insights are a must-hear for anyone seeking to lead with clarity, strengthen family legacy, or create a culture of trust in business and at home.

Introducing ‘Numbers and Narratives’: A New Quarterly Look Past Market Headlines with Matt Sheridan

We’re excited to introduce Numbers and Narratives — A Quarterly Look Past Market Headlines from TFO Wealth Partners. Each quarter, our Chief Investment Officer Matt Sheridan shares simple visuals, key takeaways, and a brief video to help you stay informed on the markets and economy — without all the noise.

TFO Wealth Partners Once Again Named One of America’s Top RIA Firms by Forbes/Shook

TFO Wealth Partners is thrilled to having been named once again as one of America’s Top RIA Firms by Forbes/Shook for 2025. We congratulate our team who help make these accolades possible and to all of the others firms named to this year’s list.

A Quick Perspective on the Government Shutdown

As of early Wednesday, government funding has lapsed after lawmakers and the White House failed to reach a spending deal. This has triggered a shutdown that will pause certain federal services and likely furlough a large number of federal employees.

Who’s Your Trustee? Why It Matters More Than You Think

In this episode, Donald shares how trustees juggle administrative, investment, and distribution duties and why “not knowing what you don’t know” can be a costly mistake.

Why Great Families Are Built, Not Born: Lessons from Bruce Feiler

In this episode, Feiler shares how a single family meeting transformed his household—and later, his three-generation family business. The power of structure, the stories that strengthen resilience, and the role of rituals over rules.

Why 90% of Wealth Disappears, and the Question That Changes Everything

In this episode, we explore why 90% of families lose their wealth within three generations—and what the 10% do differently. From legacy letters to banana peels to reflections on time, we see how families can pass down meaning, not just money.

Why Wealth Without Purpose Falls Short: Lessons from the Families Who Live It

Money without meaning leads to a disconnect, and too often, that’s the story of high-net-worth families. In the first episode of The Wealth and Purpose Podcast, Brady Fineske, CFP®, opens up about what truly drives his mission: helping families bridge the gap between financial success and emotional fulfillment.

Introducing The Wealth and Purpose Podcast: Now Streaming

We’re proud to officially announce the launch of our podcast, hosted by TFO President Brady Fineske. This show was created for families and business owners who want to make the most of what they’ve built—not just financially, but personally and generationally.

Balancing Family Preferences and Needs When Securing a Second Home

A second home is more than an investment—it’s a place to create memories and build a legacy. Thoughtful planning can help balance family preferences, align with your values, and ensure it becomes a source of joy for generations.

TFO Wealth Partners Named to FA Magazine’s List of America’s Top RIAs for 8th Consecutive Year

We’re honored to share that TFO Wealth Partners has been named to Financial Advisor Magazine’s 2025 RIA Survey & Rankings list! This recognition reflects our unwavering commitment to helping families thrive by connecting their wealth and purpose. Thank you to our clients and team for being part of this journey.

Should You Treat Your Kids Equally In Your Will? Finding the Right Balance Between Equal and Fair

Should you treat your children equally in your will? It’s one of the toughest—and most personal—questions families face during estate planning. Equal may seem fair, but sometimes fairness requires a deeper look at each child’s unique circumstances. In our latest article, we explore the emotional and practical considerations behind this important decision.

The One Big Beautiful Bill Act (OBBBA): What Families and Business Owners Need to Know

The One Big Beautiful Bill Act (OBBBA) is reshaping the financial landscape for families and business owners alike. See our summary and key planning takeaways.

Don’t Let the Noise Distract You: Four Charts That Matter with Matthew Sheridan

Worried about the markets? You’re not alone. In this informative video, TFO Wealth Partners Chief Investment Officer, Matthew Sheridan, shares 4 charts that every long-term investor should see.

Brady Fineske Recognized Among Top Advisors in the Country by AdvisorHub

We’re pleased to share that Brady Fineske, President of TFO Wealth Partners, has been named to AdvisorHub’s 2025 “1,000 Advisors to Watch” list, ranking #8 in the RIA category.

Balancing Retirement and Caregiving: How to Budget for Both

Retirement is a time to enjoy the fruits of your labor—but what happens when you also need to care for aging parents? Navigating both can be challenging, but with the right financial strategies and emotional support, it’s possible to balance both your retirement goals and caregiving responsibilities.

The Ultimate Downsizing Checklist: Simplifying Your Next Chapter

Check out our latest article that offers a step-by-step checklist to help you simplify the process—from defining your goals to finding the perfect new space. Get expert tips and guidance to make your transition smoother.

TFO Wealth Partners Has Been Named an RIA Team of the Year

We are proud to announce that TFO Wealth Partners has been named an RIA Team of the Year (10 or more Advisors) category for the 2025 InvestmentNews Awards.

Building Wealthy Habits: Six Books for Guiding Your Kids to Financial Freedom

Check out our latest article “Building Wealthy Habits: Six Books for Guiding Your Kids to Financial Freedom” that highlights six impactful books that can help parents guide their children toward financial independence.

TFO Family Wealth Strategist Named to Forbes 2025 Best-in-State Wealth Advisors List

TFO Wealth Partners is thrilled to one of its Family Wealth Strategists named to Forbes Best-in-State Wealth Advisors list for 2025. While we cannot name the specific advisor to make the list, we believe this recognition reinforces our commitment to helping our clients connect their wealth and purpose. These individual recognitions aren’t possible without the hard work and diligence of our team.

Chris Winters Named to PLANADVISER’s 2025 Top Retirement Plan Advisers List

We are proud to announce that Chris Winters, TFO Wealth Partners' Director of Retirement Plan Services, has been recognized as one of PLANADVISER’s 2025 Top Retirement Plan Advisers.

Perspective on the Headlines: Staying the Course

Markets are moving - and so are the headlines. But volatility isn’t new. This chart shows how often the S&P 500 has experienced corrections since 1950. Market pullbacks are normal, and they’ve always been part of the journey to long-term growth. Discomfort and uncertainty are the price of admission - and why staying the course matters.

Nine Technology Trends for Enhanced Travel Experiences

Check out our latest article “Nine Technology Trends for Enhanced Travel Experiences” to maximize fun and efficiency on your next trip.

Brady Fineske Recognized as a Barron’s Top 1,200 Financial Advisor

We’re proud to share that Brady Fineske, TFO Wealth Partners President and Lead Strategist, has once again been named to Barron’s Top 1,200 Financial Advisors list for 2025! This is the third consecutive year of Brady being recognized on this list. We believe this is a reflection of his dedication to helping families thrive by connecting their wealth and purpose.

Update on Beneficial Ownership Reporting – New Deadline Announced

We’ve been keeping you informed about the evolving requirements surrounding the Corporate Transparency Act (CTA), and we wanted to provide the latest update. On February 17, a federal district court judge in Texas lifted that suspension, officially reinstating the reporting requirement.

Brady Joins the Managing Your Practice Podcast

TFO Wealth Partners President Brady Fineske visited with Dimensional Fund Advisor’s Catherine Williams on the “Managing Your Practice” Podcast. Brady offered his insight and experience for the advisor community on the important connection between health and wealth and touched on a few of the TFO tools we’ve built to ‘be more’ and make meaningful impact for our client families.

Evaluating the Readiness of Family Members To Join or Take Over the Family Business

Evaluating the readiness of your children or family members to join or take over the business is one of the most important decisions you’ll make. This article explores how to assess their passion, skills, leadership potential, and alignment with your family values to ensure a smooth and successful transition.

Location, Location, Location: Choosing the Right Area For Your Second Home

For many high-net-worth families, purchasing a second home is more than a real estate transaction—it’s an investment in lifestyle, legacy, and long-term value. Here's what you need to consider when choosing the perfect area for your second home.

Simplify Your 2025 Tax Planning: Download Our New Tax Reference Guide

Our 2025 Tax Reference Guide is now available. This resource is being provided to allow you quick access to tax-related data points that may impact you over the 2025 tax year.

Welcoming a Son- or Daughter-in-Law Into the Family Wealth Conversation

Bringing a son- or daughter-in-law into your family's financial discussions is a big step. How do you share your family’s values, decide what information to disclose, and set clear roles in the conversation? Thoughtful planning is key to building trust and preserving your legacy.

2024 Year-End Planning: Control The Things You Can

As we head for the year’s home stretch, there is a host of planning items you should consider as well as some general information you should be aware of for the coming year. Read our year-end planning considerations checklist.

2024 Young Professionals Award by the Family Wealth Alliance

We are thrilled to announce that Bruce Cartwright, TFO Wealth Partners Family Wealth Strategist, has been honored with the Young Professionals Award 2024 by the Family Wealth Alliance. Congratulations, Bruce, and well deserved!

Markets and Elections Part 6: Recap and Conclusions

As we said in the beginning, a picture is worth a thousand words, and when it comes to the impact of Presidential elections on markets and your portfolio (or lack thereof) below is a quick infographic we've created to recap our series along with a final conclusion.

Markets and Elections Part 5: Markets Have Rewarded Long-Term Investors Regardless of Which Party Controls Congress

In the last part of our series, we displayed how markets have risen regardless of who is President. The same is true over time regardless of which party controls congress.

TFO Wealth Partners Named Once Again to Forbes’ America’s Top RIA Firms List for 2024

TFO Wealth Partners is thrilled to have once again be named as one of the top RIA firms in the country by Forbes/Shook for 2024. It is always an honor to be recognized for the work we do towards our mission of helping families thrive by connecting their wealth and purpose. Congratulations to our team and all the other firms recognized on this list!

Markets and Elections Part 4: Markets Have Rewarded Long-Term Investors Regardless of Who Is President

Markets and Elections Part 4 - It’s common for investors to seek a link between presidential election outcomes and stock market performance. However, nearly a century of data shows that stocks have generally risen regardless of who is President.

InvestmentNews Feature Highlights What Makes TFO Wealth Partners Different

Recently, TFO Wealth Partners' Brady Fineske sat down with InvestmentNews to discuss our firm's mission of helping families connect wealth and purpose and a core value of our of 'being more' for our clients. Brady expanded on our holistic approach to touching all parts of our client's financial life, the proprietary solutions we've built to help them live the life they want, and our people and culture that help drive all that we do.

Markets and Elections Part 3: Annualized Returns During U.S. Presidential Terms

Markets and Elections Part 3 - You may still be interested in how the market has performed over Presidential terms. As you can see, on average, the market has experienced healthy growth over presidential terms, regardless of what party holds office.

Important Update: Corporate Transparency Act (CTA)

If you have an LLC, LP, corporation, or other legal entity for business or personal purposes, please read this update as it relates to the Corporate Transparency Act (CTA).

Facts and Fantasies About a Fed Rate Cut

At its September 17-18 meeting, the Federal Reserve (“the Fed”) is expected to cut the federal funds rate. We will discuss the elements of your financial world that you should expect to change if the Fed cuts rates, and others where a Fed rate cut will likely be less impactful.

Markets and Elections Part 2: Market Returns During and After U.S. Presidential Election Years

Markets and Elections Part 2 - Wondering how markets have reacted during an election year and/or the year subsequent to a Presidential election? Wonder no more.

Markets and Elections: Three Key Takeaways

The anticipation building up to Presidential elections often brings with it questions about how financial markets will respond. To help answer these questions (and maybe a few concerns), we will be posting a 6-part series. Here are three takeaways from this series.

Four Summer Activities That Could Affect Your Tax Returns Next Year

Summer is a time for relaxation, adventure, and making memories. While it's a season to enjoy, it's also a great opportunity to stay mindful of activities that could impact your tax returns. Here are four summertime activities that can have tax implications and tips on how to navigate them for a smoother filing season next year.

Sensitive Information Stolen in National Public Data, UnitedHealth Group Breaches: What You Need to Know

National Public Data Breach Affects Nearly Three Billion People. Whenever personal information is exposed in a data breach, it’s highly recommended that you take immediate action to protect yourself from harm.

The Importance of College Students Establishing a Budget for the Coming School Year

Helping the college student(s) in your family establish a thoughtful budget for the school year can help set the foundation for a lifetime of good financial habits. Here are six ways establishing a budget for the college year can help set up your family members for future success.

Normal Turbulence in the Stock Market

No one likes uncertainty, particularly as it relates to money and investments, but it’s important to remember that declines like this are totally normal experiences and happen often.

TFO Wealth Partners Named to FA Magazine’s List of America’s Top RIAs for 7th Consecutive Year

TFO Wealth Partners has once again been named as one of America’s top Registered Investment Advisory Firms by Financial Advisor Magazine in their 2024 RIA Survey and Rankings List. This is the seventh consecutive year our firm has been named to this list, which we believe is a direct result of the hard work of our dedicated team in helping families thrive by connecting their wealth and purpose.

Brady Fineske Recognized as an Advisor on the 200 RIAs to Watch by AdvisorHub

AdvisorHub has recognized TFO Wealth Partners and Brady Fineske as one of the advisors on the 200 RIAs to Watch list. Brady, who helps lead our firm’s mission of helping families thrive by connecting their wealth and purpose, was ranked #9 advisor on the list of 200 RIAs to Watch.

Making Sense of the $5.54 Billion Visa and Mastercard Landmark Settlement for Business Owners

Visa and Mastercard have recently agreed to a $5.54 billion settlement with merchants regarding excessive credit card interchange fees, commonly known as "swipe fees."

RIA Channel’s Top 50 Wealth Managers By Growth In Assets

TFO Wealth Partners named one of the Top 50 Wealth Managers in the U.S. by growth in assets by RIA Channel – we are thrilled with this most recent recognition, further evidence we are fulfilling our mission of helping our client families thrive by connecting their wealth and purpose.

Barron’s Top 1,200 Financial Advisors List

Brady Fineske, TFO Wealth Partners President and Family Wealth Strategist, has once again been named to Barron’s 2024 America’s Top 1,200 Financial Advisors list. Congratulations Brady on this recent honor.

The Next BlackBerry?

Some investors might suggest the success of the ‘Magnificent 7’ stocks stems from an environment favoring a “winner takes all” approach where a handful of companies achieve significant market share, ultimately suppressing competition. But reaching the top of one’s respective industry, and staying on top, are two very different things.

A Few Thoughts on Spending Money

As your family adviser, we spend much of our time discussing how to invest your money. However just as, or maybe even more important, is helping you determine how you ultimately want to use your wealth to achieve life fulfillment.

Our 2024 Tax Reference Sheet Is Now Available

Our 2024 Tax Reference Sheet is now available. This resource is being provided to allow you quick access to tax-related data points that may impact you over the 2024 tax year.

History in November

The holiday season is officially upon us, and with it comes our annual opportunity to gather family and friends and share joy with those we love. It also provides a great opportunity to share stories of the past year and look back at some memorable snapshots and historic moments of the past twelve months. In the financial markets, the month of November was analogous to one of those memorable candid snapshots.

Congratulations to Our Newest Partner – Jesse MacDonald

TFO Wealth Partners is thrilled to announce Jesse MacDonald has been named our newest partner. Jesse joined our firm in 2009 and has touched many facets of our family of companies, leading our marketing efforts and developing new products and solutions for our client families. His hard work and commitment are what we look for in a TFO colleague. Please join us in congratulating Jesse as our newest partner.

2023 Year-End Planning: Control The Things You Can

As we head for the year’s home stretch, there is a host of planning items you should consider as well as some general information you should be aware of for the coming year.

FA Magazine’s RIA Survey and Rankings 2023 List

We are proud to once again have been named to FA Magazine’s Financial Advisor Magazine’s RIA Survey and Rankings List for 2023.

Potential Benefits of Lifetime Gifts

Many estate plans include a program of making lifetime gifts which has the potential to offer important rewards and benefits. Here are some of these benefits you may want to consider.

Setting a Price for Buying or Selling a Business

In the overall U.S. business landscape, mergers, takeovers, and buyouts are occurring at a steady rate. If you were to place your business on the market would you know what it is worth? Setting the price is often the most important aspect of the transaction. In this article we tackle valuation methods, the important role of taxes, and the differences and considerations of a taxable and a nontaxable transaction.

A Helpful Overview Of All Your Digital Property and Digital Assets

Digital property (or digital assets) can be understood as any information about you or created by you that exists in digital form, either online or on an electronic storage device, including the information necessary to access the digital asset. All of your digital property comprises what is known as your digital estate.

Congratulations to Our Newest Partner – Adele Sobieszczanski

TFO Wealth Partners is thrilled to announce Adele Sobieszczanski, TFO Wealth Partners Executive Vice President and Family Wealth Strategist, has been named our newest partner. Through the years, Adele has been instrumental in every facet of our business, ultimately helping lead the creation of our registered investment advisory firm and helping grow it into what it is today. If you know Adele, you know her hard work, commitment to her team, and her never-ending focus on her clients are what we look for in a TFO Wealth Partners colleague. We thank you Adele for all you continue to do for us and congratulate you on this much deserved honor.

Family Business—Laying the Groundwork for Success

For business owners considering expanding their team and allowing family members to enter the business there are some questions you may want to ask yourself before jumping in, and succession plan considerations you won’t want to miss.

Barron’s Top 1,200 Advisors Rankings by State List

We are thrilled to announce that Brady Fineske was recently ranked #12 in Ohio on Barron’s 2023 Top 1,200 Advisors, evaluated as of September 30th, 2022. We want to congratulate Brady and recognize our team of colleagues who help make this possible.

Retiring Business Owners – Plan for Succession

If you’re a small business owner, you’ve invested a great deal of time and effort into building your company. With day-to-day demands, it may be difficult to imagine your eventual transition into retirement. Yet, if you want to build personal financial security and ensure business continuation, it is important to plan ahead. Business succession planning can help create retirement income for a retiring business owner and facilitate the transfer of operations and/or ownership to family or another entity. A succession plan can also provide a strategy to handle unforeseen events, such as death or disability.

A Look at Guardianship and Older Adults

Suppose an elderly family member becomes incapacitated and has made no arrangements for such a situation. Advance directives are legal instructions that express a person’s wishes regarding financial and health care decisions in the event that he or she becomes unable to make them. If incapacity occurs and there are no advance directives, is guardianship a viable option?

Involving the Family Can Be Good Business

If you’re fortunate enough to own a small business, has your enterprise flourished into something a bit more complex than you ever would have expected? If this sounds familiar, you probably also have experienced a gradual shift in your responsibilities—from being a person in complete control to a manager attempting to oversee many facets of the business.

Retirement Contribution Limits for 2023

The IRS just announced the 2023 contribution limits for qualified retirement plans which include significant increases. Notably, the employee contribution limit is rising almost 10% to $22,500. The catch-up contribution for individuals 50 or older is increasing by $1,000 to $7,500.

TFO Wealth Partners Named to Financial Planning’s 2025 RIA Leaders List Top 150 Fee-Only RIAs

TFO Wealth Partners has been named to Financial Planning’s 2025 RIA Leaders list of the top 150 fee-only advisory firms across the country.

2025 Year-End Planning: Control The Things You Can

As we head for the year’s home stretch, there is a host of planning items you should consider as well as some general information you should be aware of for the coming year. Read our year-end planning considerations checklist.

The Seven Disciplines of Families Who Pass on More Than Money with David York

You’ll hear why the best wealth transfer plans start with values, not spreadsheets, and how tools like COREnology are helping families measure culture, not just cash flow.

Leadership Lessons That Last: Building Trust, Values, and Legacy

General Frost’s insights are a must-hear for anyone seeking to lead with clarity, strengthen family legacy, or create a culture of trust in business and at home.

Introducing ‘Numbers and Narratives’: A New Quarterly Look Past Market Headlines with Matt Sheridan

We’re excited to introduce Numbers and Narratives — A Quarterly Look Past Market Headlines from TFO Wealth Partners. Each quarter, our Chief Investment Officer Matt Sheridan shares simple visuals, key takeaways, and a brief video to help you stay informed on the markets and economy — without all the noise.

TFO Wealth Partners Once Again Named One of America’s Top RIA Firms by Forbes/Shook

TFO Wealth Partners is thrilled to having been named once again as one of America’s Top RIA Firms by Forbes/Shook for 2025. We congratulate our team who help make these accolades possible and to all of the others firms named to this year’s list.

A Quick Perspective on the Government Shutdown

As of early Wednesday, government funding has lapsed after lawmakers and the White House failed to reach a spending deal. This has triggered a shutdown that will pause certain federal services and likely furlough a large number of federal employees.

Who’s Your Trustee? Why It Matters More Than You Think

In this episode, Donald shares how trustees juggle administrative, investment, and distribution duties and why “not knowing what you don’t know” can be a costly mistake.

Why Great Families Are Built, Not Born: Lessons from Bruce Feiler

In this episode, Feiler shares how a single family meeting transformed his household—and later, his three-generation family business. The power of structure, the stories that strengthen resilience, and the role of rituals over rules.

Why 90% of Wealth Disappears, and the Question That Changes Everything

In this episode, we explore why 90% of families lose their wealth within three generations—and what the 10% do differently. From legacy letters to banana peels to reflections on time, we see how families can pass down meaning, not just money.

Why Wealth Without Purpose Falls Short: Lessons from the Families Who Live It

Money without meaning leads to a disconnect, and too often, that’s the story of high-net-worth families. In the first episode of The Wealth and Purpose Podcast, Brady Fineske, CFP®, opens up about what truly drives his mission: helping families bridge the gap between financial success and emotional fulfillment.

Introducing The Wealth and Purpose Podcast: Now Streaming

We’re proud to officially announce the launch of our podcast, hosted by TFO President Brady Fineske. This show was created for families and business owners who want to make the most of what they’ve built—not just financially, but personally and generationally.

Balancing Family Preferences and Needs When Securing a Second Home

A second home is more than an investment—it’s a place to create memories and build a legacy. Thoughtful planning can help balance family preferences, align with your values, and ensure it becomes a source of joy for generations.

TFO Wealth Partners Named to FA Magazine’s List of America’s Top RIAs for 8th Consecutive Year

We’re honored to share that TFO Wealth Partners has been named to Financial Advisor Magazine’s 2025 RIA Survey & Rankings list! This recognition reflects our unwavering commitment to helping families thrive by connecting their wealth and purpose. Thank you to our clients and team for being part of this journey.

Should You Treat Your Kids Equally In Your Will? Finding the Right Balance Between Equal and Fair

Should you treat your children equally in your will? It’s one of the toughest—and most personal—questions families face during estate planning. Equal may seem fair, but sometimes fairness requires a deeper look at each child’s unique circumstances. In our latest article, we explore the emotional and practical considerations behind this important decision.

The One Big Beautiful Bill Act (OBBBA): What Families and Business Owners Need to Know

The One Big Beautiful Bill Act (OBBBA) is reshaping the financial landscape for families and business owners alike. See our summary and key planning takeaways.

Don’t Let the Noise Distract You: Four Charts That Matter with Matthew Sheridan

Worried about the markets? You’re not alone. In this informative video, TFO Wealth Partners Chief Investment Officer, Matthew Sheridan, shares 4 charts that every long-term investor should see.

Brady Fineske Recognized Among Top Advisors in the Country by AdvisorHub

We’re pleased to share that Brady Fineske, President of TFO Wealth Partners, has been named to AdvisorHub’s 2025 “1,000 Advisors to Watch” list, ranking #8 in the RIA category.

Balancing Retirement and Caregiving: How to Budget for Both

Retirement is a time to enjoy the fruits of your labor—but what happens when you also need to care for aging parents? Navigating both can be challenging, but with the right financial strategies and emotional support, it’s possible to balance both your retirement goals and caregiving responsibilities.

The Ultimate Downsizing Checklist: Simplifying Your Next Chapter

Check out our latest article that offers a step-by-step checklist to help you simplify the process—from defining your goals to finding the perfect new space. Get expert tips and guidance to make your transition smoother.

TFO Wealth Partners Has Been Named an RIA Team of the Year

We are proud to announce that TFO Wealth Partners has been named an RIA Team of the Year (10 or more Advisors) category for the 2025 InvestmentNews Awards.

Building Wealthy Habits: Six Books for Guiding Your Kids to Financial Freedom

Check out our latest article “Building Wealthy Habits: Six Books for Guiding Your Kids to Financial Freedom” that highlights six impactful books that can help parents guide their children toward financial independence.

TFO Family Wealth Strategist Named to Forbes 2025 Best-in-State Wealth Advisors List

TFO Wealth Partners is thrilled to one of its Family Wealth Strategists named to Forbes Best-in-State Wealth Advisors list for 2025. While we cannot name the specific advisor to make the list, we believe this recognition reinforces our commitment to helping our clients connect their wealth and purpose. These individual recognitions aren’t possible without the hard work and diligence of our team.

Chris Winters Named to PLANADVISER’s 2025 Top Retirement Plan Advisers List

We are proud to announce that Chris Winters, TFO Wealth Partners' Director of Retirement Plan Services, has been recognized as one of PLANADVISER’s 2025 Top Retirement Plan Advisers.

Perspective on the Headlines: Staying the Course

Markets are moving - and so are the headlines. But volatility isn’t new. This chart shows how often the S&P 500 has experienced corrections since 1950. Market pullbacks are normal, and they’ve always been part of the journey to long-term growth. Discomfort and uncertainty are the price of admission - and why staying the course matters.

Nine Technology Trends for Enhanced Travel Experiences

Check out our latest article “Nine Technology Trends for Enhanced Travel Experiences” to maximize fun and efficiency on your next trip.

Brady Fineske Recognized as a Barron’s Top 1,200 Financial Advisor

We’re proud to share that Brady Fineske, TFO Wealth Partners President and Lead Strategist, has once again been named to Barron’s Top 1,200 Financial Advisors list for 2025! This is the third consecutive year of Brady being recognized on this list. We believe this is a reflection of his dedication to helping families thrive by connecting their wealth and purpose.

Update on Beneficial Ownership Reporting – New Deadline Announced

We’ve been keeping you informed about the evolving requirements surrounding the Corporate Transparency Act (CTA), and we wanted to provide the latest update. On February 17, a federal district court judge in Texas lifted that suspension, officially reinstating the reporting requirement.

Brady Joins the Managing Your Practice Podcast

TFO Wealth Partners President Brady Fineske visited with Dimensional Fund Advisor’s Catherine Williams on the “Managing Your Practice” Podcast. Brady offered his insight and experience for the advisor community on the important connection between health and wealth and touched on a few of the TFO tools we’ve built to ‘be more’ and make meaningful impact for our client families.

Evaluating the Readiness of Family Members To Join or Take Over the Family Business

Evaluating the readiness of your children or family members to join or take over the business is one of the most important decisions you’ll make. This article explores how to assess their passion, skills, leadership potential, and alignment with your family values to ensure a smooth and successful transition.

Location, Location, Location: Choosing the Right Area For Your Second Home

For many high-net-worth families, purchasing a second home is more than a real estate transaction—it’s an investment in lifestyle, legacy, and long-term value. Here's what you need to consider when choosing the perfect area for your second home.

Simplify Your 2025 Tax Planning: Download Our New Tax Reference Guide

Our 2025 Tax Reference Guide is now available. This resource is being provided to allow you quick access to tax-related data points that may impact you over the 2025 tax year.

Welcoming a Son- or Daughter-in-Law Into the Family Wealth Conversation

Bringing a son- or daughter-in-law into your family's financial discussions is a big step. How do you share your family’s values, decide what information to disclose, and set clear roles in the conversation? Thoughtful planning is key to building trust and preserving your legacy.

2024 Year-End Planning: Control The Things You Can

As we head for the year’s home stretch, there is a host of planning items you should consider as well as some general information you should be aware of for the coming year. Read our year-end planning considerations checklist.

2024 Young Professionals Award by the Family Wealth Alliance

We are thrilled to announce that Bruce Cartwright, TFO Wealth Partners Family Wealth Strategist, has been honored with the Young Professionals Award 2024 by the Family Wealth Alliance. Congratulations, Bruce, and well deserved!

Markets and Elections Part 6: Recap and Conclusions

As we said in the beginning, a picture is worth a thousand words, and when it comes to the impact of Presidential elections on markets and your portfolio (or lack thereof) below is a quick infographic we've created to recap our series along with a final conclusion.

Markets and Elections Part 5: Markets Have Rewarded Long-Term Investors Regardless of Which Party Controls Congress

In the last part of our series, we displayed how markets have risen regardless of who is President. The same is true over time regardless of which party controls congress.

TFO Wealth Partners Named Once Again to Forbes’ America’s Top RIA Firms List for 2024

TFO Wealth Partners is thrilled to have once again be named as one of the top RIA firms in the country by Forbes/Shook for 2024. It is always an honor to be recognized for the work we do towards our mission of helping families thrive by connecting their wealth and purpose. Congratulations to our team and all the other firms recognized on this list!

Markets and Elections Part 4: Markets Have Rewarded Long-Term Investors Regardless of Who Is President

Markets and Elections Part 4 - It’s common for investors to seek a link between presidential election outcomes and stock market performance. However, nearly a century of data shows that stocks have generally risen regardless of who is President.

InvestmentNews Feature Highlights What Makes TFO Wealth Partners Different

Recently, TFO Wealth Partners' Brady Fineske sat down with InvestmentNews to discuss our firm's mission of helping families connect wealth and purpose and a core value of our of 'being more' for our clients. Brady expanded on our holistic approach to touching all parts of our client's financial life, the proprietary solutions we've built to help them live the life they want, and our people and culture that help drive all that we do.

Markets and Elections Part 3: Annualized Returns During U.S. Presidential Terms

Markets and Elections Part 3 - You may still be interested in how the market has performed over Presidential terms. As you can see, on average, the market has experienced healthy growth over presidential terms, regardless of what party holds office.

Important Update: Corporate Transparency Act (CTA)

If you have an LLC, LP, corporation, or other legal entity for business or personal purposes, please read this update as it relates to the Corporate Transparency Act (CTA).

Facts and Fantasies About a Fed Rate Cut

At its September 17-18 meeting, the Federal Reserve (“the Fed”) is expected to cut the federal funds rate. We will discuss the elements of your financial world that you should expect to change if the Fed cuts rates, and others where a Fed rate cut will likely be less impactful.

Markets and Elections Part 2: Market Returns During and After U.S. Presidential Election Years

Markets and Elections Part 2 - Wondering how markets have reacted during an election year and/or the year subsequent to a Presidential election? Wonder no more.

Markets and Elections: Three Key Takeaways

The anticipation building up to Presidential elections often brings with it questions about how financial markets will respond. To help answer these questions (and maybe a few concerns), we will be posting a 6-part series. Here are three takeaways from this series.

Four Summer Activities That Could Affect Your Tax Returns Next Year

Summer is a time for relaxation, adventure, and making memories. While it's a season to enjoy, it's also a great opportunity to stay mindful of activities that could impact your tax returns. Here are four summertime activities that can have tax implications and tips on how to navigate them for a smoother filing season next year.

Sensitive Information Stolen in National Public Data, UnitedHealth Group Breaches: What You Need to Know

National Public Data Breach Affects Nearly Three Billion People. Whenever personal information is exposed in a data breach, it’s highly recommended that you take immediate action to protect yourself from harm.

The Importance of College Students Establishing a Budget for the Coming School Year

Helping the college student(s) in your family establish a thoughtful budget for the school year can help set the foundation for a lifetime of good financial habits. Here are six ways establishing a budget for the college year can help set up your family members for future success.

Normal Turbulence in the Stock Market

No one likes uncertainty, particularly as it relates to money and investments, but it’s important to remember that declines like this are totally normal experiences and happen often.

TFO Wealth Partners Named to FA Magazine’s List of America’s Top RIAs for 7th Consecutive Year

TFO Wealth Partners has once again been named as one of America’s top Registered Investment Advisory Firms by Financial Advisor Magazine in their 2024 RIA Survey and Rankings List. This is the seventh consecutive year our firm has been named to this list, which we believe is a direct result of the hard work of our dedicated team in helping families thrive by connecting their wealth and purpose.

Brady Fineske Recognized as an Advisor on the 200 RIAs to Watch by AdvisorHub

AdvisorHub has recognized TFO Wealth Partners and Brady Fineske as one of the advisors on the 200 RIAs to Watch list. Brady, who helps lead our firm’s mission of helping families thrive by connecting their wealth and purpose, was ranked #9 advisor on the list of 200 RIAs to Watch.

Making Sense of the $5.54 Billion Visa and Mastercard Landmark Settlement for Business Owners

Visa and Mastercard have recently agreed to a $5.54 billion settlement with merchants regarding excessive credit card interchange fees, commonly known as "swipe fees."

RIA Channel’s Top 50 Wealth Managers By Growth In Assets

TFO Wealth Partners named one of the Top 50 Wealth Managers in the U.S. by growth in assets by RIA Channel – we are thrilled with this most recent recognition, further evidence we are fulfilling our mission of helping our client families thrive by connecting their wealth and purpose.

Barron’s Top 1,200 Financial Advisors List

Brady Fineske, TFO Wealth Partners President and Family Wealth Strategist, has once again been named to Barron’s 2024 America’s Top 1,200 Financial Advisors list. Congratulations Brady on this recent honor.

The Next BlackBerry?

Some investors might suggest the success of the ‘Magnificent 7’ stocks stems from an environment favoring a “winner takes all” approach where a handful of companies achieve significant market share, ultimately suppressing competition. But reaching the top of one’s respective industry, and staying on top, are two very different things.

A Few Thoughts on Spending Money

As your family adviser, we spend much of our time discussing how to invest your money. However just as, or maybe even more important, is helping you determine how you ultimately want to use your wealth to achieve life fulfillment.

Our 2024 Tax Reference Sheet Is Now Available

Our 2024 Tax Reference Sheet is now available. This resource is being provided to allow you quick access to tax-related data points that may impact you over the 2024 tax year.

History in November

The holiday season is officially upon us, and with it comes our annual opportunity to gather family and friends and share joy with those we love. It also provides a great opportunity to share stories of the past year and look back at some memorable snapshots and historic moments of the past twelve months. In the financial markets, the month of November was analogous to one of those memorable candid snapshots.

Congratulations to Our Newest Partner – Jesse MacDonald

TFO Wealth Partners is thrilled to announce Jesse MacDonald has been named our newest partner. Jesse joined our firm in 2009 and has touched many facets of our family of companies, leading our marketing efforts and developing new products and solutions for our client families. His hard work and commitment are what we look for in a TFO colleague. Please join us in congratulating Jesse as our newest partner.

2023 Year-End Planning: Control The Things You Can

As we head for the year’s home stretch, there is a host of planning items you should consider as well as some general information you should be aware of for the coming year.

FA Magazine’s RIA Survey and Rankings 2023 List

We are proud to once again have been named to FA Magazine’s Financial Advisor Magazine’s RIA Survey and Rankings List for 2023.

Potential Benefits of Lifetime Gifts

Many estate plans include a program of making lifetime gifts which has the potential to offer important rewards and benefits. Here are some of these benefits you may want to consider.

Setting a Price for Buying or Selling a Business

In the overall U.S. business landscape, mergers, takeovers, and buyouts are occurring at a steady rate. If you were to place your business on the market would you know what it is worth? Setting the price is often the most important aspect of the transaction. In this article we tackle valuation methods, the important role of taxes, and the differences and considerations of a taxable and a nontaxable transaction.

A Helpful Overview Of All Your Digital Property and Digital Assets

Digital property (or digital assets) can be understood as any information about you or created by you that exists in digital form, either online or on an electronic storage device, including the information necessary to access the digital asset. All of your digital property comprises what is known as your digital estate.

Congratulations to Our Newest Partner – Adele Sobieszczanski

TFO Wealth Partners is thrilled to announce Adele Sobieszczanski, TFO Wealth Partners Executive Vice President and Family Wealth Strategist, has been named our newest partner. Through the years, Adele has been instrumental in every facet of our business, ultimately helping lead the creation of our registered investment advisory firm and helping grow it into what it is today. If you know Adele, you know her hard work, commitment to her team, and her never-ending focus on her clients are what we look for in a TFO Wealth Partners colleague. We thank you Adele for all you continue to do for us and congratulate you on this much deserved honor.

Family Business—Laying the Groundwork for Success

For business owners considering expanding their team and allowing family members to enter the business there are some questions you may want to ask yourself before jumping in, and succession plan considerations you won’t want to miss.

Barron’s Top 1,200 Advisors Rankings by State List

We are thrilled to announce that Brady Fineske was recently ranked #12 in Ohio on Barron’s 2023 Top 1,200 Advisors, evaluated as of September 30th, 2022. We want to congratulate Brady and recognize our team of colleagues who help make this possible.

Retiring Business Owners – Plan for Succession

If you’re a small business owner, you’ve invested a great deal of time and effort into building your company. With day-to-day demands, it may be difficult to imagine your eventual transition into retirement. Yet, if you want to build personal financial security and ensure business continuation, it is important to plan ahead. Business succession planning can help create retirement income for a retiring business owner and facilitate the transfer of operations and/or ownership to family or another entity. A succession plan can also provide a strategy to handle unforeseen events, such as death or disability.

A Look at Guardianship and Older Adults

Suppose an elderly family member becomes incapacitated and has made no arrangements for such a situation. Advance directives are legal instructions that express a person’s wishes regarding financial and health care decisions in the event that he or she becomes unable to make them. If incapacity occurs and there are no advance directives, is guardianship a viable option?

Involving the Family Can Be Good Business

If you’re fortunate enough to own a small business, has your enterprise flourished into something a bit more complex than you ever would have expected? If this sounds familiar, you probably also have experienced a gradual shift in your responsibilities—from being a person in complete control to a manager attempting to oversee many facets of the business.

Retirement Contribution Limits for 2023

The IRS just announced the 2023 contribution limits for qualified retirement plans which include significant increases. Notably, the employee contribution limit is rising almost 10% to $22,500. The catch-up contribution for individuals 50 or older is increasing by $1,000 to $7,500.

TFO Wealth Partners Named to Financial Planning’s 2025 RIA Leaders List Top 150 Fee-Only RIAs

TFO Wealth Partners has been named to Financial Planning’s 2025 RIA Leaders list of the top 150 fee-only advisory firms across the country.

2025 Year-End Planning: Control The Things You Can

As we head for the year’s home stretch, there is a host of planning items you should consider as well as some general information you should be aware of for the coming year. Read our year-end planning considerations checklist.

The Seven Disciplines of Families Who Pass on More Than Money with David York

You’ll hear why the best wealth transfer plans start with values, not spreadsheets, and how tools like COREnology are helping families measure culture, not just cash flow.

Leadership Lessons That Last: Building Trust, Values, and Legacy

General Frost’s insights are a must-hear for anyone seeking to lead with clarity, strengthen family legacy, or create a culture of trust in business and at home.

Introducing ‘Numbers and Narratives’: A New Quarterly Look Past Market Headlines with Matt Sheridan

We’re excited to introduce Numbers and Narratives — A Quarterly Look Past Market Headlines from TFO Wealth Partners. Each quarter, our Chief Investment Officer Matt Sheridan shares simple visuals, key takeaways, and a brief video to help you stay informed on the markets and economy — without all the noise.

TFO Wealth Partners Once Again Named One of America’s Top RIA Firms by Forbes/Shook

TFO Wealth Partners is thrilled to having been named once again as one of America’s Top RIA Firms by Forbes/Shook for 2025. We congratulate our team who help make these accolades possible and to all of the others firms named to this year’s list.

A Quick Perspective on the Government Shutdown

As of early Wednesday, government funding has lapsed after lawmakers and the White House failed to reach a spending deal. This has triggered a shutdown that will pause certain federal services and likely furlough a large number of federal employees.

Who’s Your Trustee? Why It Matters More Than You Think

In this episode, Donald shares how trustees juggle administrative, investment, and distribution duties and why “not knowing what you don’t know” can be a costly mistake.

Why Great Families Are Built, Not Born: Lessons from Bruce Feiler

In this episode, Feiler shares how a single family meeting transformed his household—and later, his three-generation family business. The power of structure, the stories that strengthen resilience, and the role of rituals over rules.

Why 90% of Wealth Disappears, and the Question That Changes Everything

In this episode, we explore why 90% of families lose their wealth within three generations—and what the 10% do differently. From legacy letters to banana peels to reflections on time, we see how families can pass down meaning, not just money.

Why Wealth Without Purpose Falls Short: Lessons from the Families Who Live It

Money without meaning leads to a disconnect, and too often, that’s the story of high-net-worth families. In the first episode of The Wealth and Purpose Podcast, Brady Fineske, CFP®, opens up about what truly drives his mission: helping families bridge the gap between financial success and emotional fulfillment.

Introducing The Wealth and Purpose Podcast: Now Streaming

We’re proud to officially announce the launch of our podcast, hosted by TFO President Brady Fineske. This show was created for families and business owners who want to make the most of what they’ve built—not just financially, but personally and generationally.

Balancing Family Preferences and Needs When Securing a Second Home

A second home is more than an investment—it’s a place to create memories and build a legacy. Thoughtful planning can help balance family preferences, align with your values, and ensure it becomes a source of joy for generations.

TFO Wealth Partners Named to FA Magazine’s List of America’s Top RIAs for 8th Consecutive Year

We’re honored to share that TFO Wealth Partners has been named to Financial Advisor Magazine’s 2025 RIA Survey & Rankings list! This recognition reflects our unwavering commitment to helping families thrive by connecting their wealth and purpose. Thank you to our clients and team for being part of this journey.

Should You Treat Your Kids Equally In Your Will? Finding the Right Balance Between Equal and Fair

Should you treat your children equally in your will? It’s one of the toughest—and most personal—questions families face during estate planning. Equal may seem fair, but sometimes fairness requires a deeper look at each child’s unique circumstances. In our latest article, we explore the emotional and practical considerations behind this important decision.

The One Big Beautiful Bill Act (OBBBA): What Families and Business Owners Need to Know

The One Big Beautiful Bill Act (OBBBA) is reshaping the financial landscape for families and business owners alike. See our summary and key planning takeaways.

Don’t Let the Noise Distract You: Four Charts That Matter with Matthew Sheridan

Worried about the markets? You’re not alone. In this informative video, TFO Wealth Partners Chief Investment Officer, Matthew Sheridan, shares 4 charts that every long-term investor should see.

Brady Fineske Recognized Among Top Advisors in the Country by AdvisorHub

We’re pleased to share that Brady Fineske, President of TFO Wealth Partners, has been named to AdvisorHub’s 2025 “1,000 Advisors to Watch” list, ranking #8 in the RIA category.

Balancing Retirement and Caregiving: How to Budget for Both

Retirement is a time to enjoy the fruits of your labor—but what happens when you also need to care for aging parents? Navigating both can be challenging, but with the right financial strategies and emotional support, it’s possible to balance both your retirement goals and caregiving responsibilities.

The Ultimate Downsizing Checklist: Simplifying Your Next Chapter