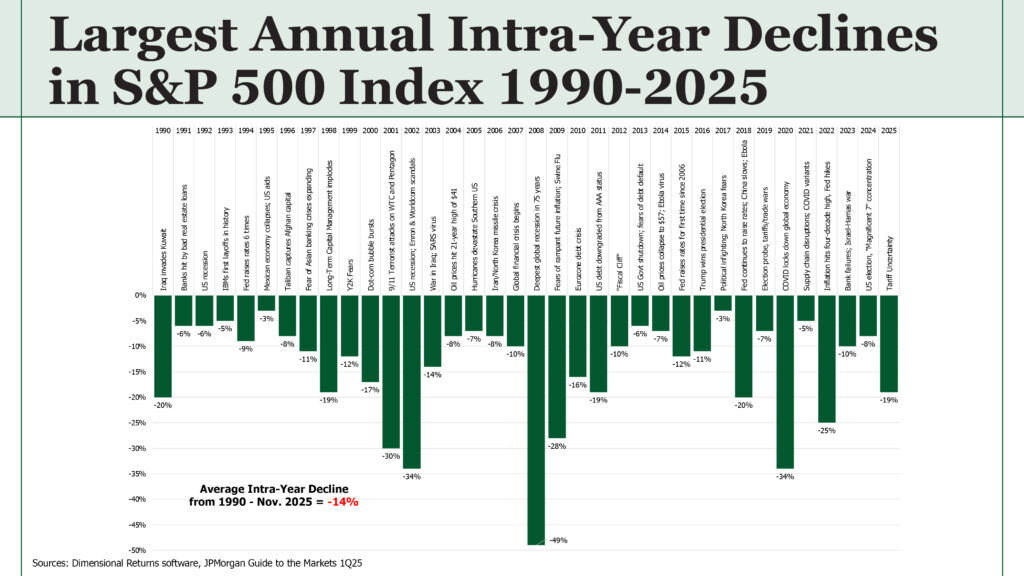

The Reality of Market Volatility

2025 reminded investors that volatility is a feature, not a bug, of equity investing. Despite 29 days where markets dropped more than 1% and a sharp 19% decline during tariff uncertainty from February to April, the year ended with strong positive returns and 39 new all-time highs.

This pattern isn’t new. Since 1990, markets have experienced an average intra-year decline of 14%, yet three-quarters of these years still ended in positive territory. Understanding this historical context helps investors maintain composure when headlines generate anxiety.

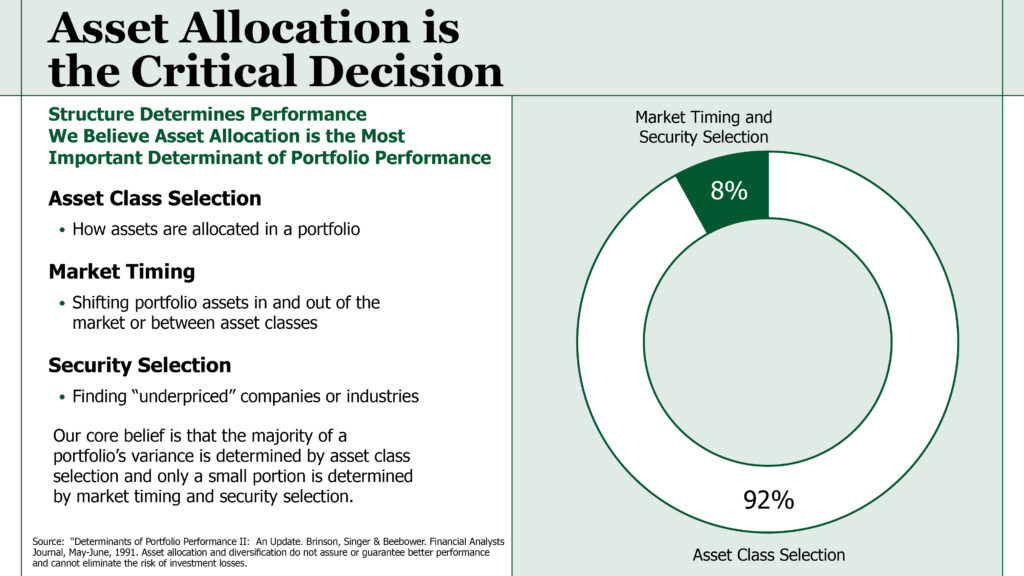

Asset Allocation Drives Performance

The structure of your portfolio determines far more than most investors realize. Research consistently shows that 92%1 of portfolio returns come from asset allocation decisions, the mix of stocks, bonds, and other asset classes, rather than individual security selection or market timing attempts.

2025 proved this principle again. When U.S. stocks declined sharply in early spring, diversified portfolios with international exposure and fixed income holdings weathered the storm more effectively. Diversification across non-correlated assets remains one of the most reliable risk management tools available.

1 Source: “Determinants of Portfolio Performance II: An Update. Brinson, Singer & Beebower. Financial Analysts Journal, May-June, 1991. Asset allocation and diversification do not assure or guarantee better performance and cannot eliminate the risk of investment losses.

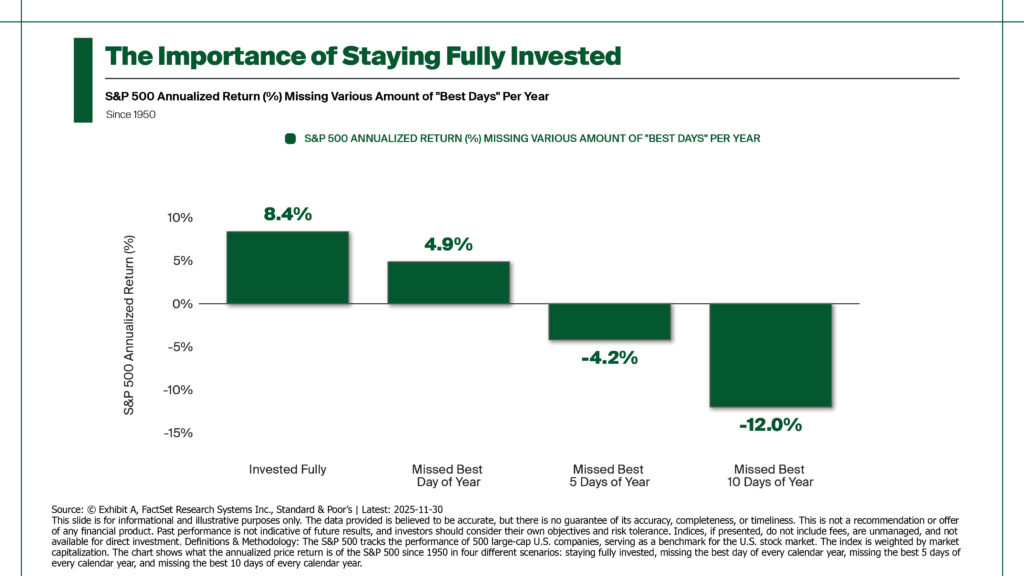

Staying Invested Matters More Than Timing

The best and worst market days tend to cluster together, making market timing nearly impossible. Missing just the single best day in 2025, April 9th when markets surged 9.5%, would have cut annual returns by more than half. Over longer periods, the math becomes even more stark: missing the 10 best days since 1950 turns positive returns into significant losses2

This clustering effect is why remaining invested through volatility is critical. Investors who exit during downturns often miss the sharp recovery days that follow, permanently impairing their long-term wealth accumulation.

2 Source: © Exhibit A, FactSet Research Systems Inc., Standard & Poor’s | Latest: 2025-11-30) reference slide 8.

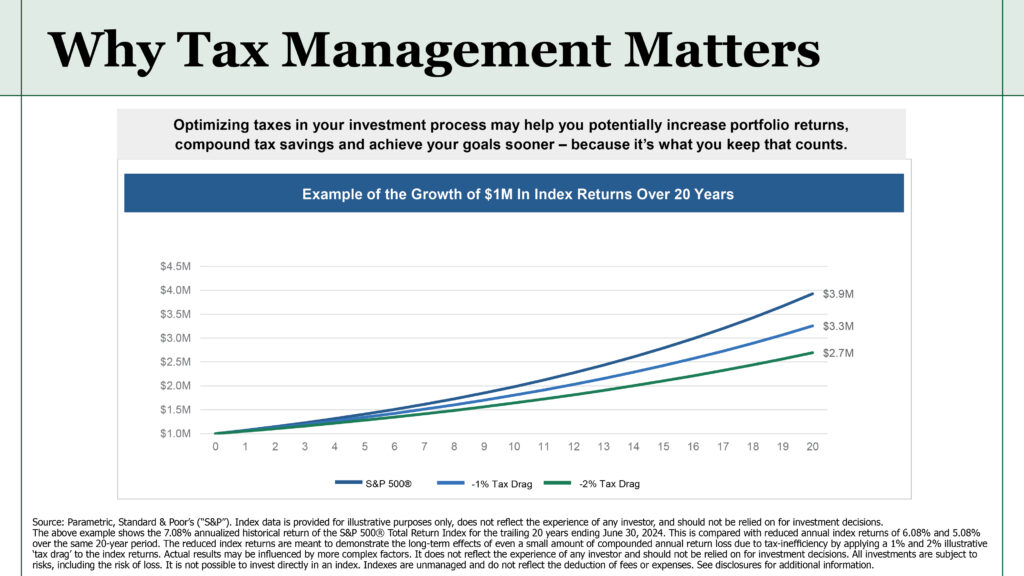

Tax Management Adds Measurable Value

The difference between a portfolio with 1% annual tax drag and one with 2% may seem small, but it compounds into substantial wealth differences. Over 20 years, that single percentage point difference on a $1 million portfolio could creates over $500,000 in additional wealth.

Strategies like systematic tax-loss harvesting throughout the year, optimizing asset location across different account types, and using appreciated securities for charitable giving can dramatically reduce tax drag and accelerate wealth building.

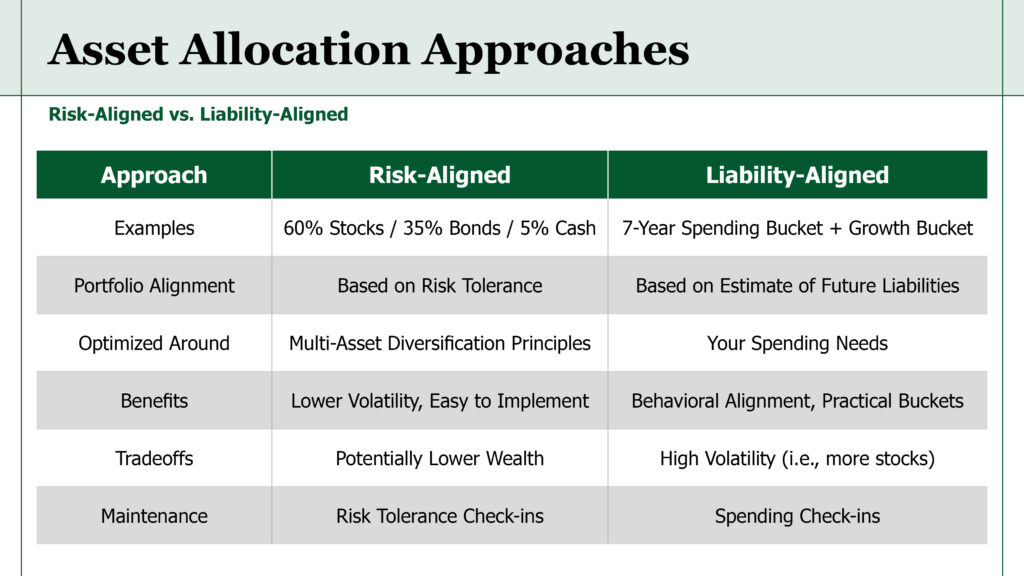

Two Approaches to Portfolio Structure

Investors can construct portfolios using a risk-aligned approach, traditional stock-bond ratios based on volatility tolerance, or a liability-aligned approach, bucketing assets based on spending timelines. Risk-aligned strategies work well for wealth accumulators seeking simplicity. Liability-aligned approaches suit those drawing income, providing psychological comfort by separating near-term spending needs from long-term growth assets.

Neither approach is inherently superior. The right choice depends on individual circumstances, behavioral preferences, and financial goals. What matters most is selecting a strategy and maintaining consistency through market cycles.