As of early Wednesday, government funding has lapsed after lawmakers and the White House failed to reach a spending deal. This has triggered a shutdown that will pause certain federal services and likely furlough a large number of federal employees.

Shutdowns can affect the economy in many ways: missed paychecks, delays in key data releases, and disruptions for businesses tied to government activity, etc. The longer it lasts, the wider the range of potential outcomes on economic growth and capital markets.

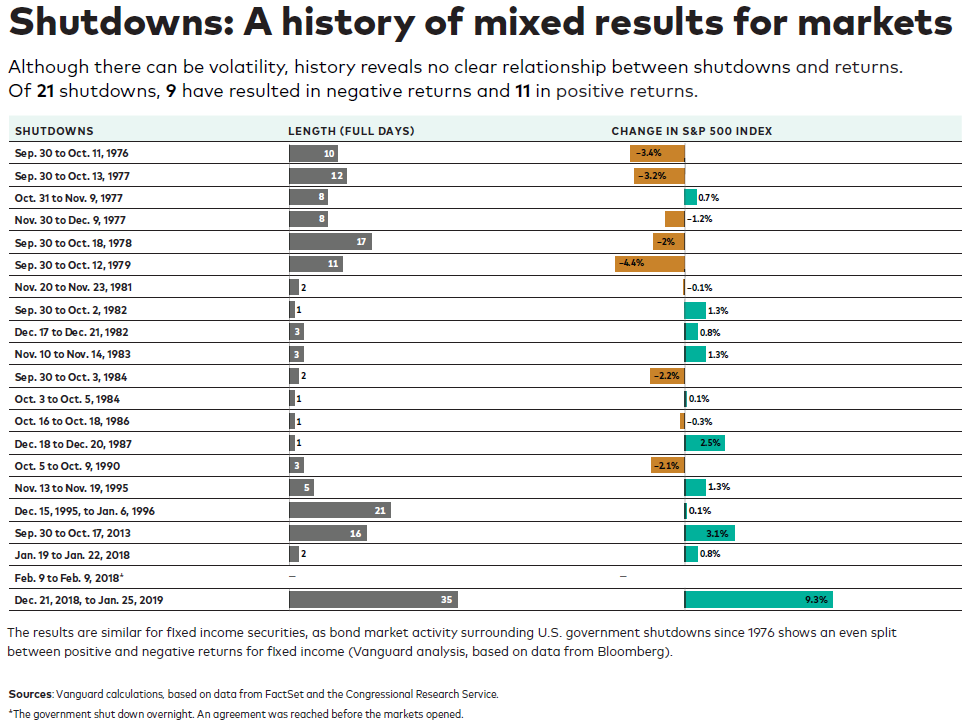

This isn’t new. Since 1976 there have been 21 shutdowns, each with different conditions and outcomes. Markets have reacted in mixed ways. History shows no consistent pattern: 11 shutdowns saw stock gains, while 9 saw declines, and 1 was resolved overnight before the markets opened.

Government shutdowns have not been reliable predictors of market performance. Trying to time them rarely works. Our advice: diversify across asset classes and geographies, prioritize after-tax returns, manage costs, and most importantly, remain disciplined in your approach.

As always, if you have any questions related to this topic, your TFO Wealth Partners adviser is happy to discuss.

Past Performance is no guarantee of future returns. The performance of an index is not an exact representation of any particular investment, as you cannot invest directly in an index.

As always, please keep us apprised, in writing, of any changes to your personal/financial situation or investment objectives. Also, if you would like to add or modify, any reasonable restrictions to our investment advisory services, please contact us so we may evaluate and properly manage your account(s) and service you. We shall continue to rely on the accuracy of information that you have provided.

Advisory services provided by TFO Wealth Partners, LLC. We believe this information provided is reliable, but do not warrant its accuracy or completeness. It is provided for informational purposes only and should not be construed as legal or tax advice. Laws may change pursuant to the new administration’s legislative agenda. Always consult an attorney or tax professional regarding your specific legal or tax situation.

443bWP – 2025.10