As we head for the year’s home stretch, there is a host of planning items you should consider as well as some general information you should be aware of for the coming year.

PLANNING ITEMS

One Big Beautiful Bill Act (“OBBBA”)

Congress passed the “One Big Beautiful Bill Act,” which includes several key tax updates effective beginning in 2025.

- Tax Rates – The Act codifies the current Tax Cuts and Jobs Act (TCJA) rates that were previously scheduled to expire at the end of 2025.

SALT Deduction Cap – The limit on state and local tax (SALT) deductions increases from $10,000 to $40,000 for the years 2025 through 2029.

Wages and Payroll - Depending on the benefits that are offered through your employer, you may have access to an FSA, HSA, or both. Below are items to be aware of with each, be sure to check your benefits or consult your employer or your benefits handbook to determine what you have available.

Flexible Spending Account (“FSA”)

Look to use up your FSA funds before year-end. Depending on the plan, employers allow a carryover from 2025 to 2026 of up to $660. Some plans also include a 2½-month grace period that extends the balance of your FSA into 2026. Employers are not required to offer these extensions—please check with your employer to determine if your FSA includes either of these benefits.

Goal – To use and not lose the money you contributed to your “FSA.”

Health Savings Account (“HSA”)

Maximize your pre-tax “HSA” contributions. $8,550 is the maximum you can contribute to your “HSA” in 2025 for family coverage. $4,300 is the maximum amount you can contribute for self-only coverage.

Goal – To maximize pre-tax savings and save for future healthcare needs. You have until 4/15/2026 to make these contributions effective for the 2025 tax year if you are self-funding. If your HSA is funded via your employer, funding is typically limited to the calendar year. The statutory deadline for contributing to your HSA is through the un-extended deadline for filing your income tax return. Normally, that’s April 15th after the close of the tax year.

There is also a $1,000 catch-up contribution for individuals aged 55 or older.

401(k) Contributions

Maximize contributions to 401(k) plans of $23,500 and $31,000 if age 50 and older.

Goal – To maximize pre-tax savings and save for retirement.

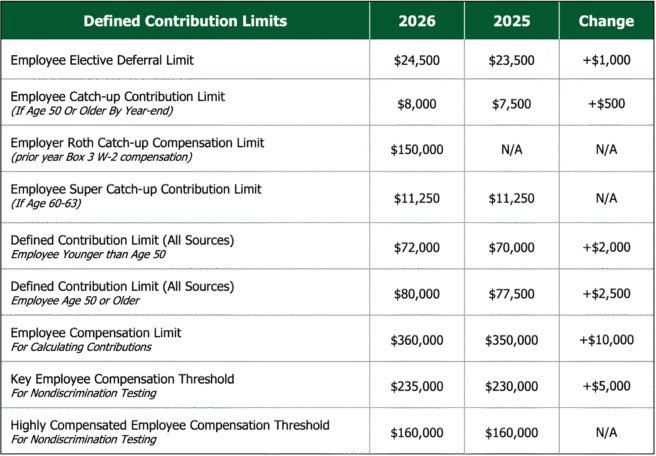

Also, the IRS just announced the 2026 contribution limits for qualified retirement plans. The employee contribution limit rises from $23,500 to $24,500. The catch-up contribution for individuals 50 or older increases from $7,500 to $8,000. Individuals who are between ages 60-63 can make a catch-up contribution of $11,250.

The defined contribution limit, which is the combined total between employee and employer contributions climbs to $72,000 which is an increase of $2,000. The employee compensation limit which restricts the amount of compensation eligible for calculating contributions is going up by $10,000 to $360,000.