What Changed Since Q3

This quarterly series is designed to keep you informed on global markets and economic conditions, while also providing context and perspective along the way. Like last quarter, this update is paired with a short video, so you can engage with the content in the way that works best for you.

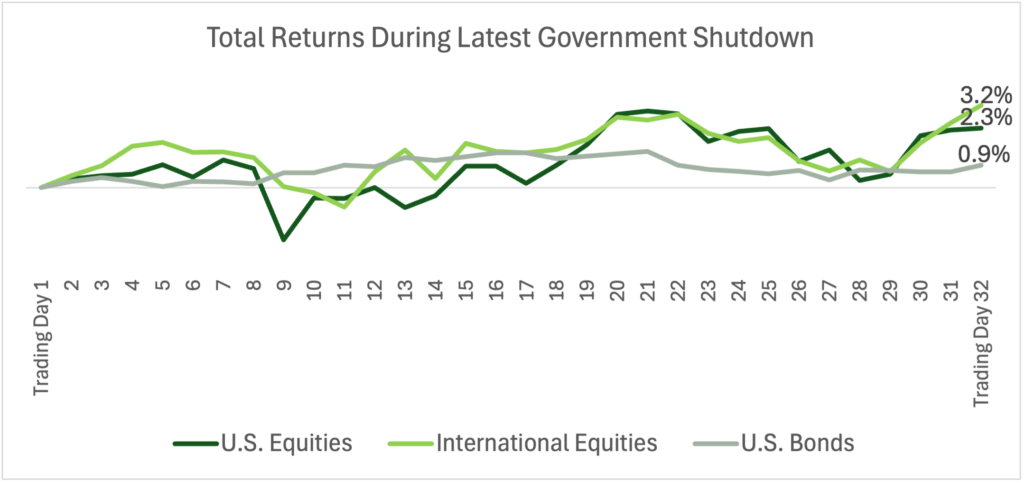

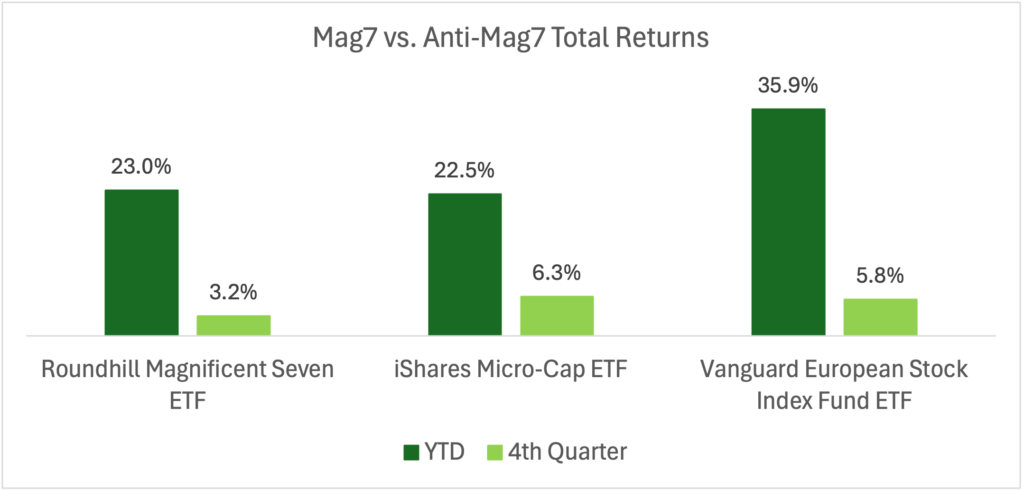

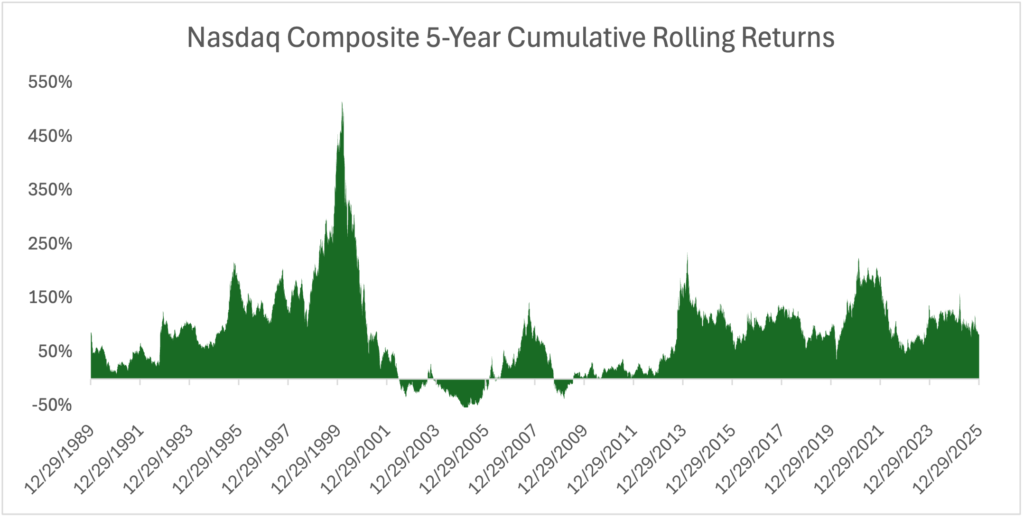

Q4 was a busy quarter by any measure. It began with the longest government shutdown in U.S. history, included multiple interest rate cuts by the Federal Reserve, saw a brief but sharp equity market pullback tied to concentration and AI bubble concerns, and unfolded against a steady drumbeat of geopolitical headlines.

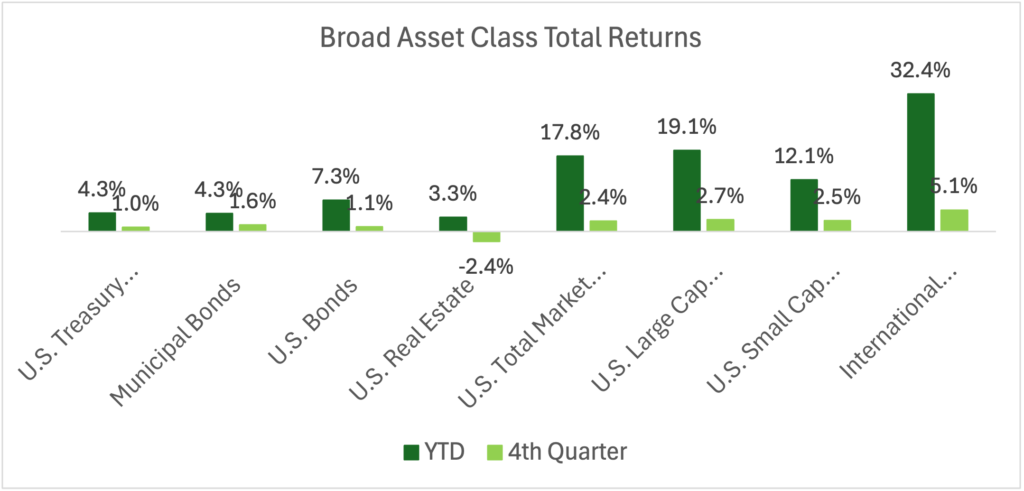

Yet despite those narratives, markets remained resilient.

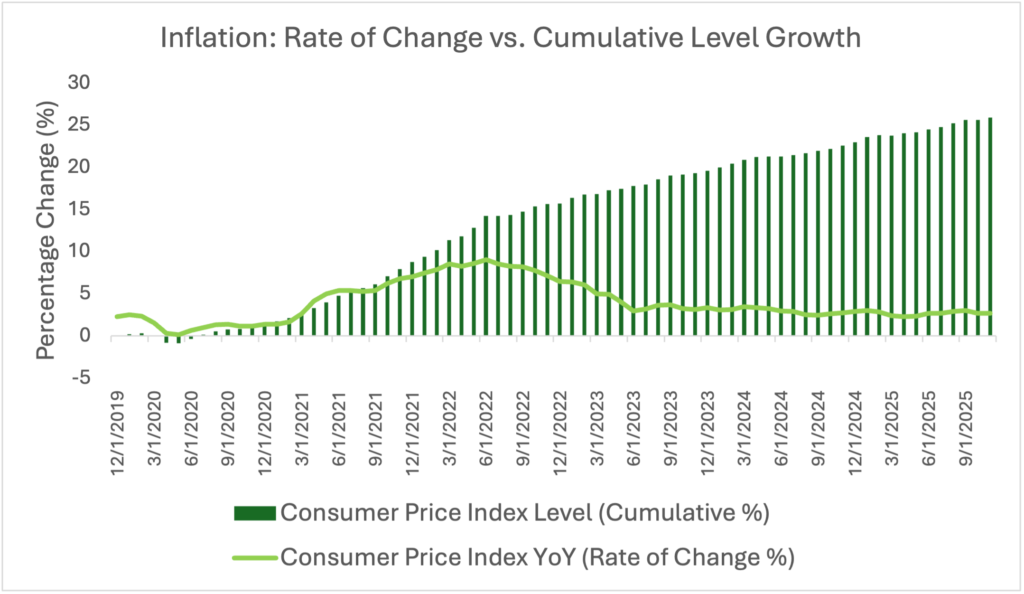

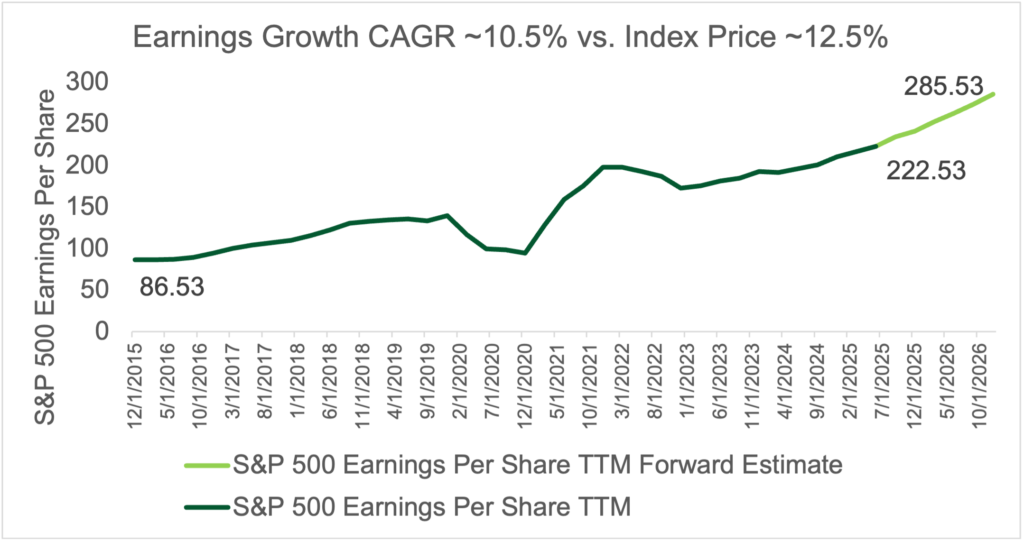

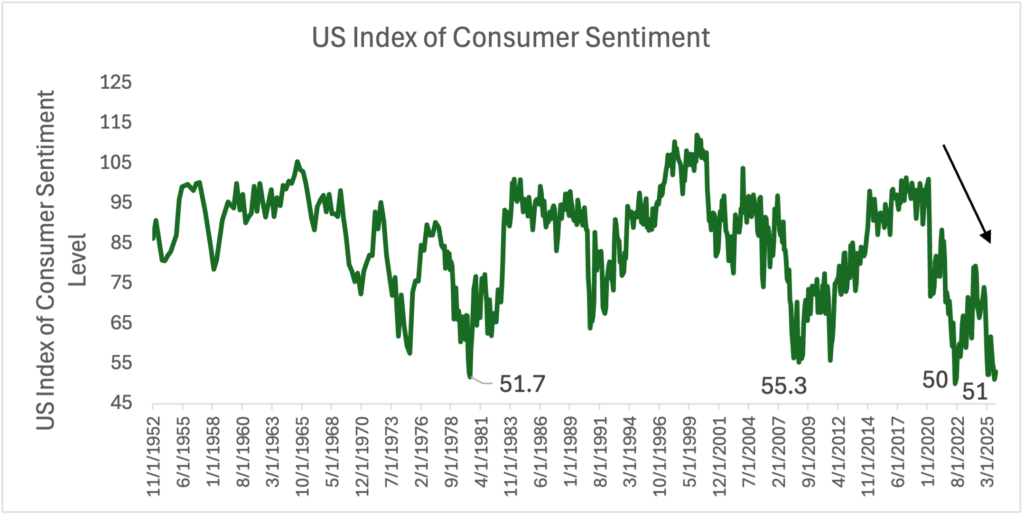

What stood out most was the growing disconnect between how people feel about the economy and what the underlying data continues to show. Measures of consumer sentiment hovered near levels last seen during major crises, even as global stock markets pushed to all-time highs, supported by strong corporate profits and improving inflation trends.

That gap between perception and reality became one of the defining features not only of the quarter, but of 2025.