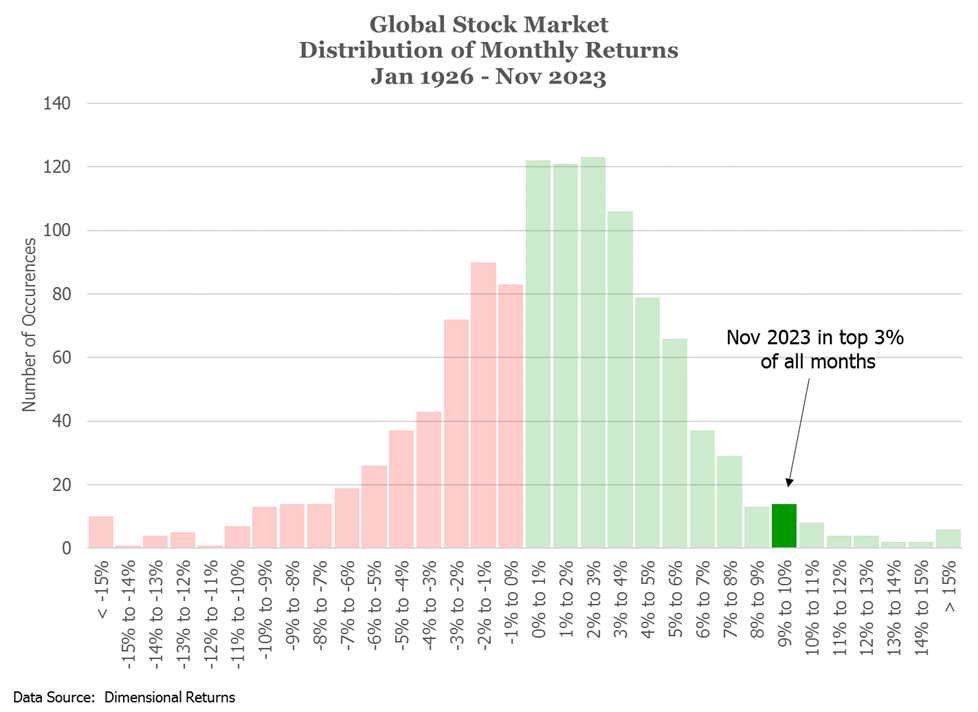

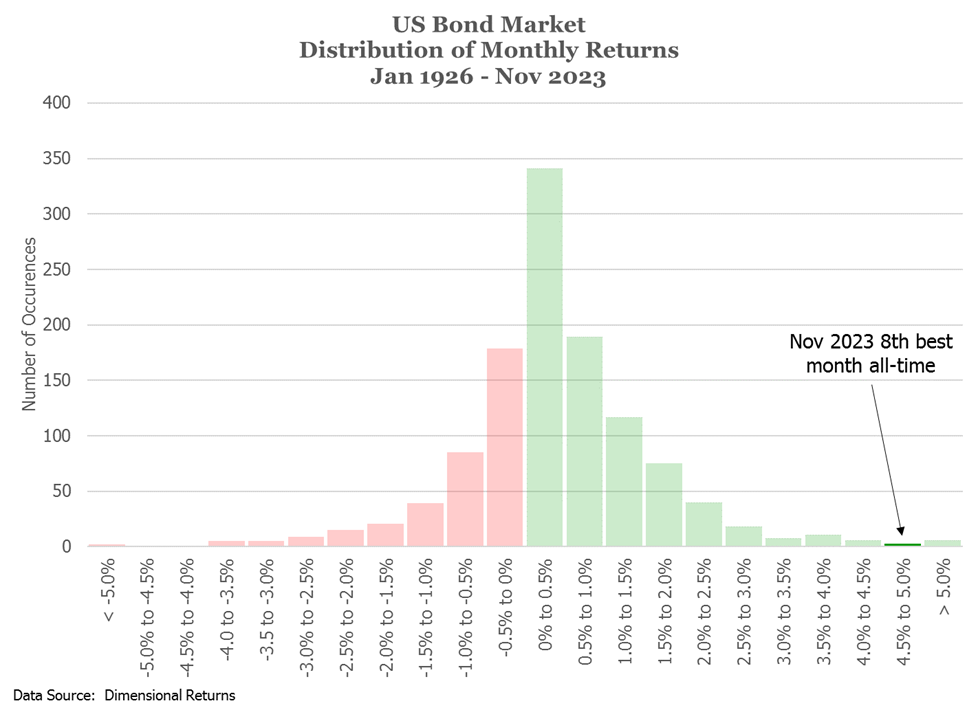

Note: Throughout this document, the Global Stock Market refers to the following blend on indexes: CRSP 1-10 US Market from 1926-1969, M¬SCI World from 1970-1987 and MSCI All-Country World from 1988-present. The US Bond Market refers to the following blend of indexes: US 5-Year Treasury from 1926-1972, Bloomberg US Govt/Credit Bond Index from 1973-1975, and Bloomberg US Aggregate Bond Index from 1976-present. Indexes are not available for investment and do not take into consideration fees and expenses.

1Data Source: Dimensional Returns

TFO Wealth Partners (“TFO”) is registered as an investment advisor with the SEC and only transacts business in states where it is properly registered, or is excluded or exempted from registration requirements. SEC registration does not constitute an endorsement of the firm by the Commission nor does it indicate that the advisor has attained a particular level of skill or ability.

This communication is intended to be informational in nature and is not intended to be construed as individualized financial advice or a specific recommendation. All expressions of opinion are subject to change and should not be construed as an offer to buy or sell, or a solicitation of any offer to buy or sell the securities mentioned. We believe this information provided is reliable, but do not warrant its accuracy or completeness. It is provided for informational purposes only and should not be construed as legal or tax advice. TFO is not in the practice of law.

Past performance may not be indicative of future results. Therefore, no current or prospective client should assume that the future performance of any specific investment or strategy will be profitable or equal to past performance levels. All investment strategies have the potential for profit or loss. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will either be suitable or profitable for a client’s portfolio. There are no assurances that a portfolio will match or outperform any particular benchmark.

Certain information herein has been obtained from third party sources and, although believed to be reliable, has not been independently verified and its accuracy or completeness cannot be guaranteed. No representation is made with respect to the accuracy, completeness or timeliness of this document.

This document may contain forward-looking statements relating to the objectives, opportunities, and the future performance of the U.S. market generally. Forward-looking statements may be identified by the use of such words as; “believe,” “expect,” “anticipate,” “should,” “planned,” “estimated,” “potential” and other similar terms. Examples of forward-looking statements include, but are not limited to, estimates with respect to financial condition, results of operations, and success or lack of success of any particular investment strategy. All are subject to various factors, including, but not limited to general and local economic conditions, changing levels of competition within certain industries and markets, changes in interest rates, changes in legislation or regulation, and other economic, competitive, governmental, regulatory and technological factors affecting a portfolio’s operations that could cause actual results to differ materially from projected results. Such statements are forward-looking in nature and involve a number of known and unknown risks, uncertainties and other factors, and accordingly, actual results may differ materially from those reflected or contemplated in such forward-looking statements. Prospective investors are cautioned not to place undue reliance on any forward-looking statements or examples. None of TFO or any of its affiliates or principals nor any other individual or entity assumes any obligation to update any forward-looking statements as a result of new information, subsequent events or any other circumstances. All statements made herein speak only as of the date that they were made.

179bWP – 2023.12