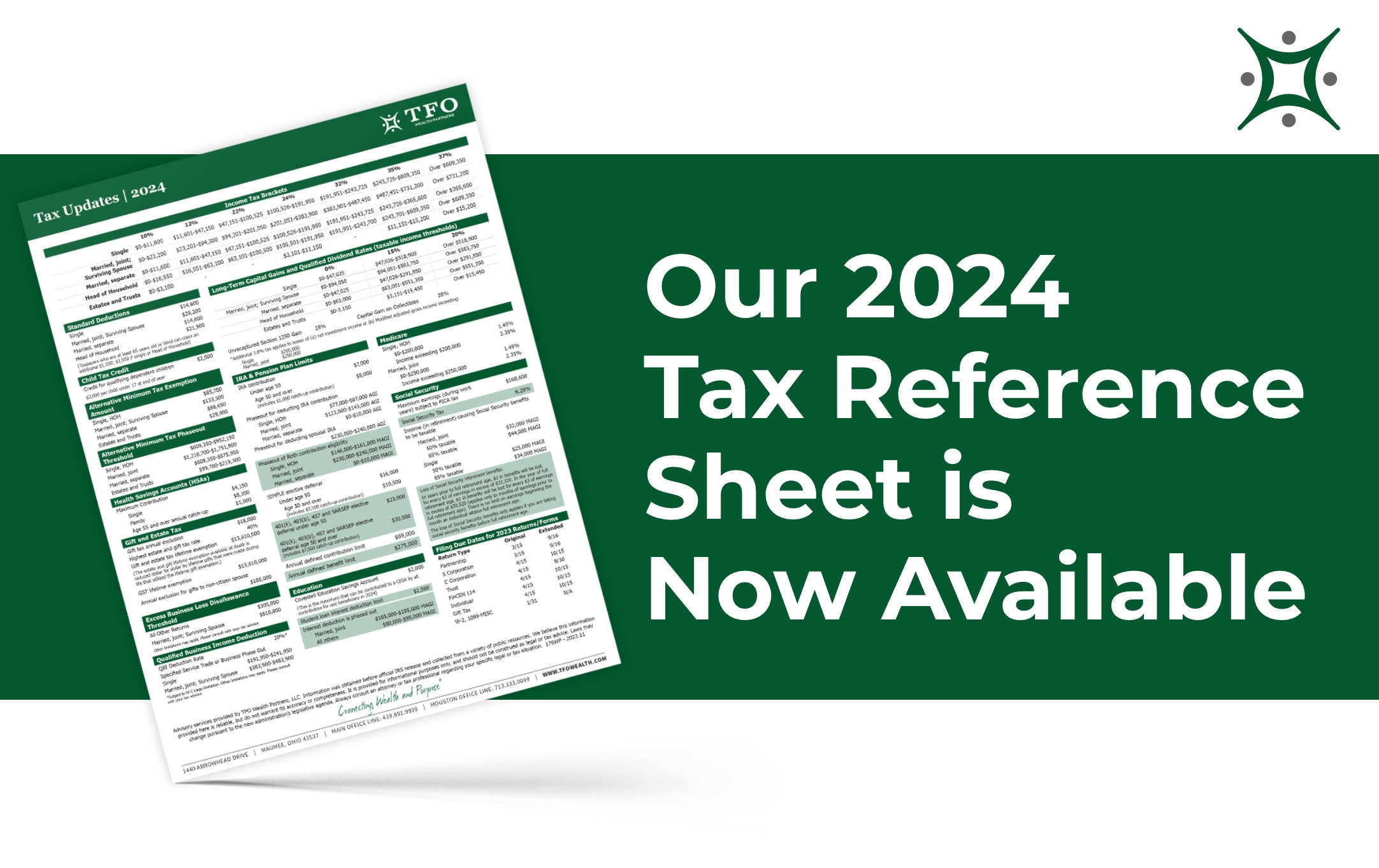

As we have done in years past, our 2024 Tax Reference Sheet is now available and can be downloaded at the bottom of this email. This resource is being provided to allow you quick access to tax-related data points that may impact you over the 2024 tax year.

There are a few common items we wanted to specifically call out and believe you should consider as you plan out your year:

- The IRA (Traditional and Roth) Contribution Limits have increased to $7,000 (up from $6,500) – catch up for those 50 and over is $8,000.

- Reminder: You have until tax filing day, April 15th to get any 2023 contributions in.

- The Salary Deferral Limit for employees in 401(k), 403(b), 457(b) or TSP plans is increasing to $23,000. (up from $22,500). The catch-up limit for those over 50 will not change and remains at $7,500.

- If you consistently max out your retirement plan, please update your contribution rate to take full advantage of the new limits.

- The HSA Contribution Limit has also increased to $4,140/person ($8,300 for a family) and the catch up for those over 55 is an additional $1,000/person (must have an HSA eligible plan).

- Contact your payroll provider or adjust your monthly contributions to max out this opportunity.

- RMD Withdrawal Amounts have also been updated for 2024.

- You can always give a portion of this amount to charity – this is called a Qualified Charitable Distribution and it is the only way to get your pre-tax IRA money out without paying any taxes. You can start to take advantage of this once you turn 70.5 (before you are required to take your RMD).

If you have any questions about the information in this guide or do not find the information you need, please contact your TFO Wealth Partners adviser. As always, we stand ready to help you get the answers you need.