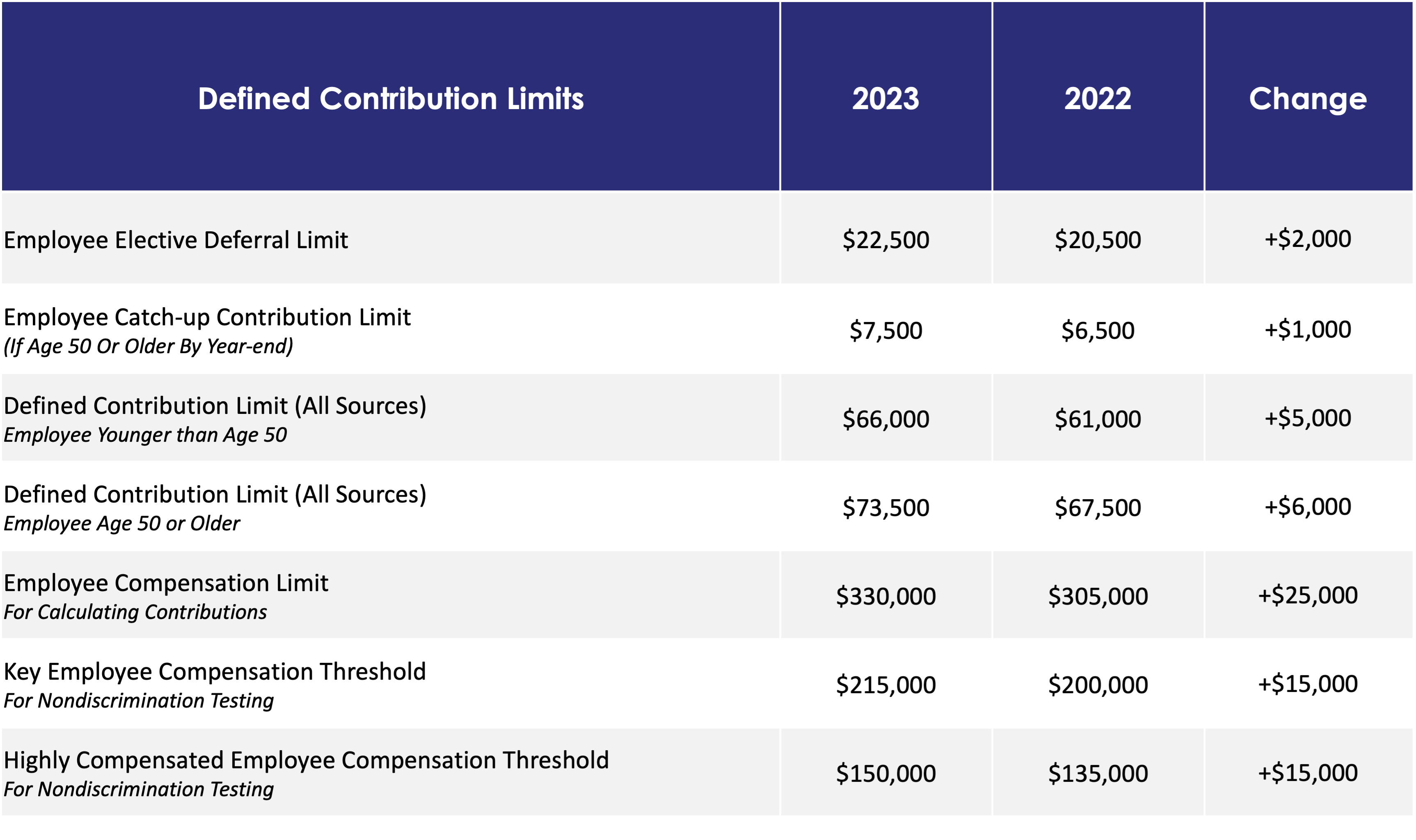

The IRS just announced the 2023 contribution limits for qualified retirement plans which include significant increases.

Notably, the employee contribution limit is rising almost 10% to $22,500. The catch-up contribution for individuals 50 or older is increasing by $1,000 to $7,500.

The defined contribution limit which is the combined total between employee and employer contributions is climbing to $66,000 which is an increase of $5,000.

The employee compensation limit which restricts the amount of compensation eligible for calculating contributions is going up by $25,000 to $330,000.