Some investors might suggest the success of the ‘Magnificent 7’ stocks stems from an environment favoring a “winner takes all” approach where a handful of companies achieve significant market share, ultimately suppressing competition. But reaching the top of one’s respective industry, and staying on top, are two very different things.

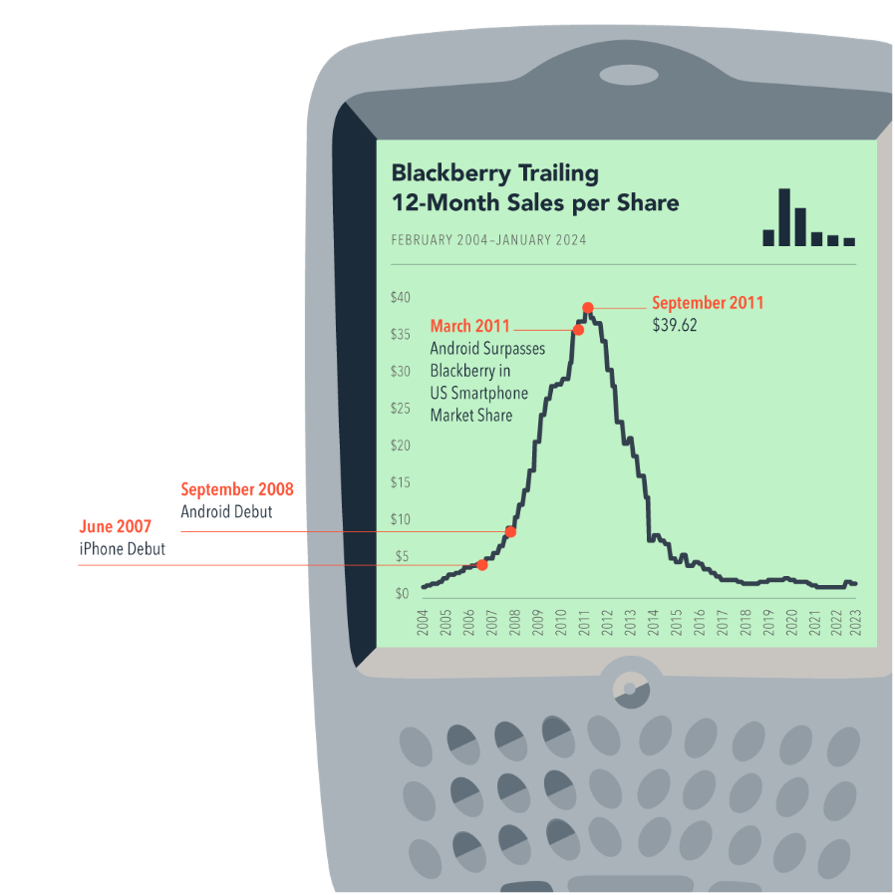

A great example of this is the mobile phone market. Looking back 15 years, you wouldn’t be reading this on your iPhone, but instead, you’d probably be reading this on your BlackBerry. The overwhelming leader in mobile business communication at the time, BlackBerry’s foothold on the market eroded once Apple and Androids suddenly entered the space.

There are many examples of industry titans, whose products and services were engrained in our daily lives, that were ultimately usurped by the next big thing. Remember, Sears was a top-10 sized stock in the US a number of years ago. AOL was the major player in internet access in the 90’s, and in the early 2000’s the major social platforms were Friendster and MySpace.

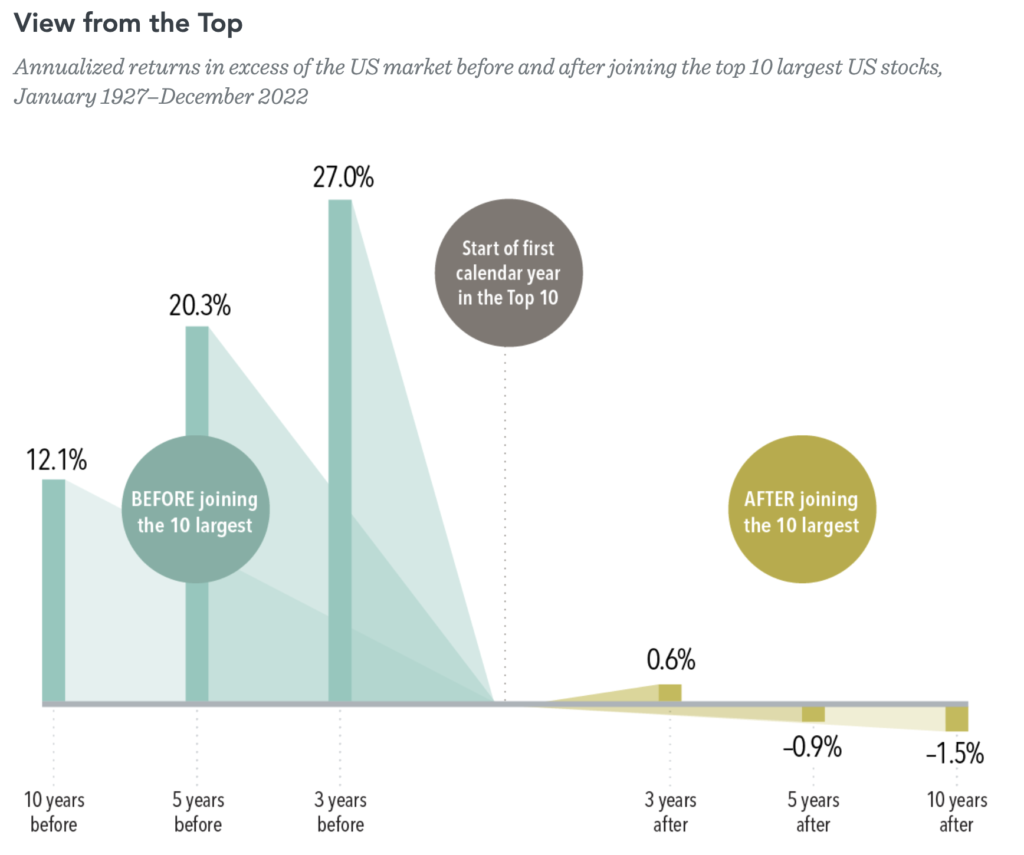

Even the largest, most dominant companies have uncertain futures, which is why investors should seek a broadly diversified portfolio to capture the returns of whatever companies ascend to the top in the future. Even if these companies stay at the top of their respective markets, there is no assurance higher returns will continue in the future. To highlight this point, see figure 2 below. The surprising returns of these stocks tend to occur before they reach the top of the market, but once there, subsequent returns tend to lag the market.

Past performance is not a guarantee of future results.

In USD. Data from CRSP and Compustat. Companies are sorted every January by beginning-of-month market capitalization to identify first-time entrants into the top 10. The market is defined as the Fama/French Total US Market Research Index. The Fama/French indices represent academic concepts that may be used in portfolio construction and are not available for direct investment or for use as a benchmark. Eugene Fama and Ken French are members of the Board of Directors of the general partner of, and provide consulting services to, Dimensional Fund Advisors LP. See “Index Description” for a description of the Fama/French index data. Indices are not available for direct investment. The index has been included for comparative purposes only.

Sources: Dimensional Fund Advisors. “Magnificent 7 Outperformance May Not Continue” Wes Crill. December 2023.

Dimensional Fund Advisors. “The Next BlackBerry?” Wes Crill. February 2024.

Important disclosures:

Advisory services provided by TFO Wealth Partners, LLC. Past performance is not indicative of future results. This article is designed to be informational in nature and is not intended to be construed as financial advice or a specific recommendation. This article was not prepared in conjunction with or reviewed by Dimensional Fund Advisors.

Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment or strategy will be suitable or profitable for an investor’s portfolio. Changes in investment strategies, contributions or withdrawals, and economic conditions may materially alter the performance of an investor’s portfolio. Asset allocation and diversification do not assure or guarantee better performance and cannot eliminate the risk of investment losses. All expressions of opinion are subject to change and should not be construed as an offer to buy or sell, or a solicitation of any offer to buy or sell the securities mentioned. We believe this information provided is reliable, but do not warrant its accuracy or completeness.

This article contains third party sources and is being provided for informational purposes only and does not necessarily represent the opinions of TFO Wealth Partners. We believe this information provided is reliable, but do not warrant its accuracy or completeness. TFO Wealth Partners does not provide any guarantee, express or implied, that the information presented is accurate or timely, and does not contain inadvertent technical or factual inaccuracies.

TFO Wealth Partners is registered as an investment adviser with the SEC and only transacts business in states where it is properly registered or is excluded or exempted from registration requirements. SEC registration does not constitute an endorsement of the firm by the Commission, nor does it indicate that the adviser has attained a particular level of skill or ability.

217bWP – 2024.02